Six months after selling its Appalachian Basin portfolio to focus on the oily Eagle Ford Shale, Penn Virginia Corp. (PVA) said its operations in the latter were moving forward while proved reserves of oil and natural gas liquids (NGL) had increased during 2012.

Portfolio

Articles from Portfolio

Denbury Buys ConocoPhillips’ Cedar Creek Anticline Portfolio

ConocoPhillips is selling a package of properties in the Cedar Creek Anticline (CCA) of North Dakota and Montana to Denbury Resources Inc. for $1.05 billion cash.

EDF Buys ConocoPhillips’ Midwest C&I Gas Portfolio

Europe’s EDF Trading has acquired ConocoPhillips’ Midwest commercial and industrial (C&I) natural gas portfolio, the EDF Group subsidiary said Thursday. Financial details of the transaction were not disclosed.

SandRidge Takes $2.6B for Permian Portfolio

SandRidge Energy Inc. last week agreed to sell its Permian Basin portfolio for $2.6 billion in cash to privately held Sheridan Production Partners II, a sale that has been anticipated since early November.

SandRidge Sells Permian Portfolio for $2.6B

SandRidge Energy Inc. on Wednesday agreed to sell its Permian Basin portfolio for $2.6 billion in cash to privately held Sheridan Production Partners II, a sale that has been anticipated since early November.

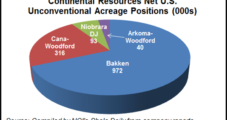

Bakken-Fueled Continental Aiming to Triple Output, Reserves

Continental Resources Inc. has launched a growth plan to triple production and proved reserves between now and the end of 2017, largely from its leading Bakken Shale position, but also with gains from other onshore holdings, including a discovery in the southwest corner of Oklahoma.

ExxonMobil Builds Bakken Portfolio with Denbury Agreement

ExxonMobil Corp. has increased its hold in the Bakken Shale to nearly 600,000 net acres after agreeing to acquire Denbury Resources Inc.’s entire portfolio in the play, 196,000 net acres. The North Dakota and Montana properties had average production in the first six months of this year of about 15,400 boe/d, 88% weighted to oil and liquids.

Industry Brief

Oregon regulators extended for another 12 months the same portfolio of retail energy options for private-sector natural gas and electric utility customers throughout the state. The Oregon Public Utility Commission (PUC) followed the recommendation of a third-party options committee in letting stand current programs for residential and nonresidential customers of NW Natural, PacifiCorp and Portland General Electric Co. The programs are designed to give utility customers options for supporting alternative energy development. Customers will continue to be able to voluntarily participate in NW Natural’s greenhouse gas emissions offset program and the two electric utilities’ offers for time-of-use, green source and wind power sources.

Talisman Exits Canadian Shale-Based GTL Project

Calgary-based Talisman Energy is abandoning a project it had considered with Sasol Canada to develop Canada’s first gas-to-liquids (GTL) facility to create transportation fuels from natural gas.

EOG’s ‘Big Four’ Plays Boost Oil, Liquids Production

First quarter performance from EOG Resources Inc.’s “big four” oil and liquids plays was substantial enough to raise this year’s total company liquids production growth target to 33% from 30% and increase the overall production growth target to 7% from 5.5%.