Physical natural gas prices fell a couple of pennies on average Wednesday, but if constrained market points in the East on pipelines such as Algonquin, Iroquois, Transco, and Tennessee were held out of the mix, then the overall market loss would increase to about a nickel. Futures trading was light and traders suggest now might be a good time to sell irrespective of Thursday’s inventory report. At the close of futures trading April fell 5.9 cents to $3.470 and May dropped 5.6 cents to $3.519.

Points

Articles from Points

Midwest Gains Pace Weather-Driven Advance; Futures Rise

Physical natural gas prices at most points across the country rose about a dime Tuesday, but if the highly volatile Northeast is added to the mix, the overall change is a loss of about 3 cents.

Tight LNG Supplies Lead Northeast Advance; Futures Seen Lower

The overall physical natural gas market Tuesday on average gained 12 cents, but if super-sized gains scored at Northeast points are removed from the tally, the overall gain was a more modest 7 cents. Gains, nonetheless, were widespread and only a couple of locations didn’t make it to the positive side of the trading ledger. At the close of futures trading, March had fallen 4.9 cents to $3.230 and April was off 5.0 cents to $3.296. March crude oil added 48 cents to $97.51/bbl.

Cash Lackluster Outside of Strong Northeast; Futures Bulls Make It Four In A Row

Natural gas cash prices Tuesday for Wednesday delivery were uninspired except for in the Northeast, where some points flirted with $2 gains as forecasts turned cooler and power prices surged. February futures gained 8.2 cents to $3.455 and March was higher by 7.5 cents to $3.453. February crude oil fell 86 cents to $93.28/bbl.

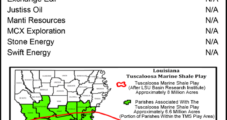

Tuscaloosa Trend Could ‘Make-or-Break’ in 2013

Analysts are keeping an eye on costs and production results from the still-emerging Tuscaloosa Marine Shale (TMS), but Amelia Resources LLC is going “100 mph” to market 47,300 net acres in the play, which management believes may hold a resource potential of more than 1 billion bbl.

Higher North American Onshore Resource Estimates Forecast for 2013

Higher natural gas and oil resource estimates should continue through 2013 for several onshore unconventional areas, especially in “pockets of the Permian Basin,” the Niobrara formation, as well as the Eagle Ford and “super-rich” Marcellus and Utica shales, according to Credit Suisse.

Oneok’s Bakken Crude Express Not Leaving the Station

The Bakken Shale may be booming, but Oneok Partners LP’s recent open season for the proposed Bakken Crude Express Pipeline was a bust, and the project has been scrapped, the partnership said Tuesday.

Northeast, California Lead Broad Gains; Futures Flounder

Cash prices overall staged a broad rally Monday with an average gain in the double digits. Northeast and West Coast points were notably strong as power generation was reported as lean and next-day loads were forecast to increase. Gulf and eastern locations were also strong. At the close of trading December futures had fallen 7.1 cents to $3.719 and January had lost 6.7 cents to $3.837. January crude oil vaulted $2.36 to $89.28/bbl.

Northeast, Midwest Hit by Moderating Weather Forecasts; Futures Rise

Cash prices overall tumbled 17 cents on average Thursday as weather outlooks changed abruptly. Northeastern points were the hardest hit with prices free-falling upwards of $2 at some locations, but the East and Texas suffered losses as well. At the close of futures trading December had risen 3.0 cents to $3.608 and January was higher by 2.3 cents to $3.737. December crude oil gained 65 cents to $85.09/bbl.

Cash Firms and Futures Endure a Bearish Storage Report

The overall cash market outdistanced the volatile futures market and added 7 cents on average Thursday. Particular strength was noted at Midcontinent points as cold temperatures raced into the nation’s midsection. Eastern and Gulf prices were also firm.