Permian Basin giant Pioneer Natural Resources Co. has formally adopted targets by 2030 to sharply cut emissions across its Lower 48 operations, and it plans to tie executive incentive compensation to the goals. The strategy, to cut greenhouse gas (GHG) emissions by 25%, with methane emission intensities by 40%, was laid out in the Dallas-based…

Tag / Permian Basin

SubscribePermian Basin

Articles from Permian Basin

Tellurian Drops Plans for 2.3 Bcf/d Permian Global Access Pipeline

One day after disclosing that CEO Meg Gentle had departed the company, Tellurian Inc. on Tuesday withdrew from FERC’s review a proposed 2.3 Bcf/d Permian Basin natural gas artery that would have moved supply to the Louisiana coast. The Permian Global Access Pipeline (PGAP) had been under the microscope by Tellurian for months as it…

Contango Snags Rockies, Permian ‘Low-Decline’ Oil, NGL Assets

Contango Oil & Gas Co. is set to expand its footprint in the Big Horn, Permian and Powder River basins after agreeing to purchase bank-owned liquidated assets for $58 million. Under the purchase and sale agreement announced Monday, the Fort Worth, TX-based independent is to acquire around 7,500 boe/d of production, 18.3 million boe of…

LNG 101: Defining Small-Scale LNG and its Advantages

Liquefied natural gas (LNG) is a growing business across the world, and a key part of that growth is in small-scale applications that provide energy solutions and allow consumption of the super-chilled fuel in remote areas, but the “small-scale” label can be a confusing one. Small-scale LNG is generally considered to include the production and…

Oasis Emerges from Bankruptcy with $1.8B Less Debt, New Ticker

Houston-based Oasis Petroleum Inc., which works the Permian and Williston basins, has completed a financial restructuring and emerged from bankruptcy. The independent, which filed for Chapter 11 protection in late September, said it has reduced its prepetition debt by $1.8 billion. It is trading on Nasdaq under “OAS.” “Oasis is now uniquely positioned with a…

MPL to Source U.S. Gas for Potential Second LNG Project on Mexico’s Pacific Coast

Mexico’s Pacific Coast could see more than one natural gas export project being developed in the coming years as Asian markets increase their appetite for imports of cheap and reliable U.S. gas via the shortest transport route possible. Mexico Pacific Limited LLC’s (MPL) CEO Doug Shanda thinks his company’s liquefied natural gas (LNG) export project…

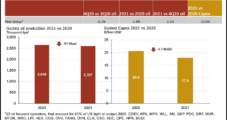

U.S. Onshore D&C Spending Cuts to Far Outpace Oil Output Decline in 2021, Rystad Says

Oil production from U.S. shale plays is likely to hit a floor in 2021 with no further declines expected in a $40 to $45/bbl West Texas Intermediate (WTI) price environment, according to new analysis by Rystad Energy. Output is expected to fall by an estimated 3.1% year/year to 7.5 million b/d in 2020 from 7.7…

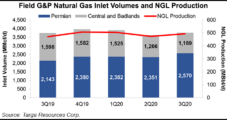

Targa Boosting Permian Natural Gas Processing Capacity by Moving North Texas Plant

Targa Resources Corp. is relocating a cryogenic natural gas processing plant to the Permian Basin from North Texas to boost what it said is much needed capacity in the region. The Houston-based midstream operator said the Longhorn plant would be moved to the Midland sub-basin in West Texas to accommodate increasing production. The 200 MMcf/d…

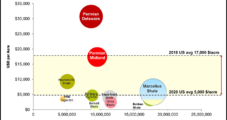

Lower 48 E&P Consolidation Likely to Increase on Lower WTI, Acreage Prices

The average price for U.S. onshore unconventional acreage has declined by more than 70% in the last two years, a precursor to more consolidation through 2022, according to Rystad Energy. The price for Lower 48 acreage fell on average to $5,000/acre this year from $17,000 in 2018, the result of lower West Texas Intermediate (WTI)…

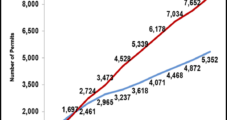

Oil, Gas Permits for Lower 48 Federal Land Climb Ahead of Biden’s Election

U.S. explorers during October increased their oil and gas permit requests for the third month in a row, with an uptick in developing leaseholds on federal lands, according to Evercore ISI. The analyst firm each month provides data using state and federal sources regarding permits for oil and gas wells, plugging and abandoned (P&A) wells…