PJM Interconnection LLC, which serves 65 million across the Mid-Atlantic, said it is armed to combat winter, with adequate fuel and energy supplies to meet a forecast peak demand of about 137 GW. The regional transmission operator serves customers in Delaware, Illinois, Indiana, Kentucky, Maryland, Michigan, New Jersey, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West…

Peak

Articles from Peak

We Energies Moving Ahead With LNG Peak Shaving Facilities in Wisconsin

CB&I has been tapped to build two liquefied natural gas (LNG) storage tanks for peak shaving facilities under development in southeastern Wisconsin, where demand has increased for incremental firm deliveries. Utility We Energies is developing the small-scale LNG terminals to better meet natural gas demand on the coldest days of the year and cut its…

LNG 101: The Fine Lines Between Baseload, Peak and Nameplate Liquefaction Capacity

Feed gas deliveries to U.S. liquefied natural gas (LNG) export terminals that are running at or near peak capacity have grabbed headlines since colder weather settled in across the Northern Hemisphere in recent weeks. But what does it mean for an LNG plant to run at peak capacity? Never before have so many liquefaction trains…

SoCal Citygate Reaches New Highs as Mercury Rises; Natural Gas Futures Retreat

A heat wave Monday led to the most expensive natural gas spot trades recorded at SoCal Citygate going back to at least 2008, as a volatile mixture of elevated gas-fired electric demand and ongoing supply constraints blew the roof off of prices. Largely driven by gains in California and the Desert Southwest, the NGI National Spot Gas Average surged 51 cents to $3.22/MMBtu.

Jagged Peak Cites Permian Well Delays in 4Q; CEO Unexpectedly Stepping Down

Denver-based Jagged Peak Energy Inc., whose expertise is centered in the Permian Basin, said well delays cut into fourth quarter production results, which should be rectified this year. However, the unexpected decision by CEO Joseph N. Jaggers to step aside in March overshadowed preliminary results.

ERCOT Foresees Adequate Power For Spring, Summer

The Electric Reliability Council of Texas (ERCOT) should have enough generating capacity to meet expected power demand this spring and summer, the grid operator said Wednesday.

Brief — ERCOT

The Electric Reliability Council of Texas (ERCOT), the grid operator for most of the state, set a new winter peak demand record between 7 and 8 a.m. CST on Monday. Cold weather drove power demand to an hourly peak of 57,958 MW, according to initial data. The previous winter peak of 57,265 MW was set Feb. 10, 2011. The new winter record exceeds the previous December demand record of 53,642 MW (set Dec. 10, 2013, between 7 and 8 a.m.) by more than 4,000 MW. As a cold front blew into the state over the weekend, the ERCOT system also experienced a new record for instantaneous wind generation output. Wind output reached 15,195 MW at 6:20 p.m. on Saturday, topping the previous record of 15,033 set Nov. 27, 2016. ERCOT recently said an improving economy has lifted power demand in the Lone Star State, which gets most of its power from natural gas-fueled plants.

California Summer Electricity Supplies Adequate Despite Gas Storage Outage, CAISO Says

California’s electric grid operator said on Wednesday that summer power supplies should be adequate even after the closure of the state’s largest natural gas storage facility in Southern California.

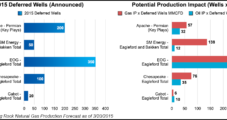

Slowing, But No Decline, Expected in U.S. Natural Gas Output Through 2015

U.S. natural gas production should peak in May or June, but summer output is going to be higher than it was a year ago, analysts with Genscape Inc. said Wednesday.

Tropical Weather System, Above Normal Temps Pressure Cash, Futures Higher

Physical natural gas prices for Wednesday delivery advanced on average another 11 cents Tuesday as continued forecasts for well above normal temperatures along the Eastern Seaboard, combined with the organization of an area of low pressure over the western Caribbean Sea, maintained upward pressure on next-day pricing. With few exceptions, all points were up by a dime or more, and some locations added close to a quarter.