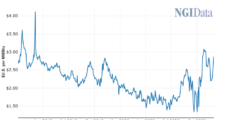

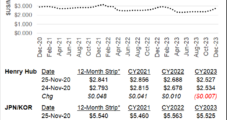

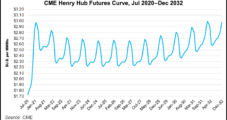

Although the natural gas supply outlook has improved in recent weeks, analysts are steadfast in their convictions that higher prices are needed in the coming months to prevent a significant supply shortfall next winter. A Goldman Sachs Commodities Research team, led by Samantha Dart, said this week it is maintaining a $3.25/MMBtu price forecast for…

Outlook

Articles from Outlook

ExxonMobil Retreats on Spending, with ‘Significant’ Natural Gas Development Off The Table

ExxonMobil is backing off ambitious goals to increase spending and is slicing the book value of some of its assets, particularly the U.S. dry natural gas portfolio, by up to $20 billion. Following an annual strategic review by the board in late November, the Irving, TX-based energy giant on Monday said it has revised its…

U.S. Natural Gas Prices to Average $3.30 in 2021, with Summer Even Higher, Says BofA

U.S. natural gas prices are forecast to average $3.30/MMBtu in 2021, with even higher prices predicted next summer, according to BofA Securities. The analyst team led by Francisco Blanch, head of commodities and derivatives research, discussed the outlook for energy overall during a webcast on Tuesday. “The bottom line is that higher prices are needed…

Range Remaining Disciplined Despite Improving Natural Gas Outlook

Range Resources Corp. has ended production curtailments imposed in September and October in response to weak Appalachian natural gas prices, but even with an improved outlook, there are no plans to increase activity. Range cut 210 MMcf/d of natural gas production during the second half of September and most of October as Appalachian storage levels…

Lower 48 Tight Oil Output to Recover, but Possibly Not As Strong Pre-Covid, Says OPEC

U.S. tight oil production should recover quickly as world energy demand recovers from Covid-19, but Lower 48 output may not again hit its previous forecasts, the Organization of the Petroleum Exporting Countries said Thursday. The Saudi-led oil cartel, aka OPEC, in its flagship 14th annual World Oil Outlook (WOO), cited the “unprecedented scale and impact”…

BP Impairing Up to $17.5B in Assets on ‘Enduring Impact’ from Covid-19 and Quicker Energy Transition

With an expectation that the energy transition away from fossil fuels may be sooner than expected, BP plc on Monday said it plans to impair up to $17.5 billion on the value of its assets for the second quarter because of limited upside in natural gas and oil prices.

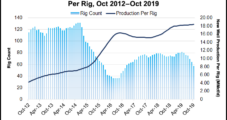

U.S. E&Ps Improving Efficiencies, Cash Flow Heading Into 2020

Editor’s Note: This is one of a 14-piece series NGI undertook as the energy industry readied for the new year, with Lower 48 natural gas and oil supply continuing to surge in an uncertain environment as liquefied natural gas exports ramp up, Mexico markets remain shrouded and stakeholders demand more value. Get your complimentary copy of NGI’s 2020 Special Report today.

Schlumberger Expecting NAM Land Activity to Plunge 10%

Schlumberger Ltd., the No. 1 oilfield services (OFS) operator in the world, is forecasting a sharp pullback in U.S. and Canadian onshore activity this year, while domestic offshore and overseas activity are on an upward trajectory.

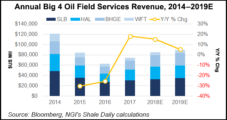

OFS Likely Off to Slow Start in 2019 on Falling Oil Prices

The oilfield services (OFS) sector, slowly returning to normal following the downturn four years ago, now faces more uncertainty, as oil prices continue to decline and Lower 48 producers trim spending plans for 2019.

Permian Taking It Away (or Not) in Earnings Calls, Analysts Predict

There are, to be sure, plenty of prolific oil and natural gas basins across North America that onshore operators are plowing successfully. However, all eyes and ears during second quarter calls to discuss results are likely to be trained on potential capacity constraint issues in the Permian Basin, and looming pipeline shortages in the Williston and Anadarko basins, according to analysts.