Capital spending by exploration and production (E&P) companies likely will continue this year at a fairly modest pace but analysts foresee expenditures rising in 2022 from strong cash flow and tighter oil and gas supply. A revival in global capital expenditures is underway following the downturn of 2020, but producers are remaining disciplined in their…

Onshore

Articles from Onshore

API, Chamber Urge Biden Administration to Lift Moratorium on Federal Oil, Natural Gas Leasing

The American Petroleum Institute (API) and the U.S. Chamber of Commerce joined Republican leaders in calling on the Biden administration to lift its temporary pause on federal oil and natural gas leasing after a Louisiana district court ordered the moratorium be lifted. Fourteen states in March challenged President Biden’s executive order (EO), which in January,…

EIA Modeling June Oil Production Growth on Strength of Permian Output

Driven by the Permian Basin, oil production out of seven key U.S. onshore regions is set to grow from May to June, while natural gas production is on track to decline, according to the updated projections from the Energy Information Administration (EIA). In its latest Drilling Productivity Report (DPR), EIA said it expects the Anadarko,…

EIA Projects Continued Decline in U.S. Natural Gas, Oil Output from Key Onshore Plays in April

Natural gas production from seven key U.S. regions is set to fall by 316 MMcf/d from March to April, extending a downward trajectory in projected output from the domestic plays that goes back to early last year, according to new data published Monday by the U.S. Energy Information Administration (EIA). Combined output from the Anadarko,…

U.S. Land Permitting Collapses in November, Driven by Permian, Haynesville

Lower 48 oil and natural gas permitting during November plunged by nearly one-third month/month, with activity in the Permian Basin and Haynesville Shale sharply down, according to Evercore ISI. Evercore analysts led by James West compile a monthly review of federal and state permitting. According to the data, exploration and production (E&P) companies requested 32%…

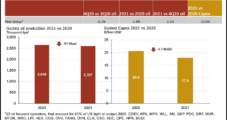

U.S. Onshore D&C Spending Cuts to Far Outpace Oil Output Decline in 2021, Rystad Says

Oil production from U.S. shale plays is likely to hit a floor in 2021 with no further declines expected in a $40 to $45/bbl West Texas Intermediate (WTI) price environment, according to new analysis by Rystad Energy. Output is expected to fall by an estimated 3.1% year/year to 7.5 million b/d in 2020 from 7.7…

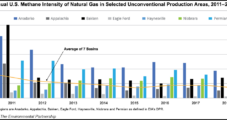

Oil, Gas Environmental Partnership Expands to Include Pipeline Companies

The Environmental Partnership, a coalition of oil and natural gas producers formed to accelerate improvements to environmental performance in U.S. onshore operations, said Wednesday it has expanded its membership to midstream companies. The addition of pipeline companies has more than tripled the organization’s membership to 83 participants. The Environmental Partnership was formed in December 2017.…

NGI The Weekly Gas Market Report

4Q2019 Earnings: Noble Ties Natural Gas Growth to Leviathan, with Lower 48 Liquids Driven by DJ, Permian

Houston-based Noble Energy Inc. spent less and produced more in 2019, boosted by the ramp of the Leviathan natural gas field offshore Israel and better performance from Lower 48 properties in Colorado and Texas.

Equinor, Shell Snap Up Schlumberger Acreage in Argentina’s Vaca Muerta

Norway’s Equinor SA and Royal Dutch Shell plc have have jointly purchased a 49% interest held by Schlumberger Ltd. in the Bandurria Sur onshore block in Argentina’s Neuquén province.

Lower 48 to Lead Oilfield Equipment Spending in 2020s, Says Westwood

Led by onshore spending in the United States, oilfield equipment (OFE) expenditures should continue to increase in the 2020s, reaching a forecast peak of $133 billion in 2023, according to Westwood Global Energy Group.