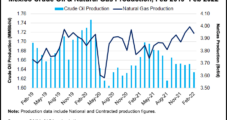

The oil-rich consortium of countries known as OPEC-plus on Thursday affirmed its intentions, first signaled earlier in June, to ramp up production in July and August. It is targeting output growth of 648,000 b/d both months. If the cartel could meet its goals, the group’s average crude generation would climb to nearly 44 million b/d…

Tag / Oil prices

SubscribeOil prices

Articles from Oil prices

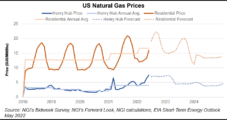

E&P and OFS Execs Foresee $7.55 Natural Gas, $108 Oil by Year’s End

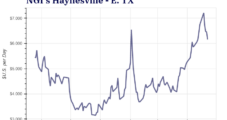

Natural gas and oil industry executives across Texas, northern Louisiana, and southern New Mexico expect a Henry Hub natural gas price of $7.55/MMBtu and a West Texas Intermediate (WTI) oil price of $108/bbl by the end of this year, according to the Federal Reserve Bank of Dallas. The Dallas Fed, as it is known, obtained…

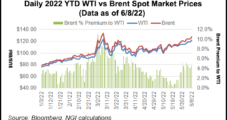

Brent to Average $108 in Last Half of 2022, EIA Says

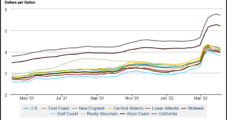

Brent crude oil prices will average $108/bbl in the second half of 2022 as low global inventory levels heighten potential volatility and as geopolitical actions increase uncertainty, the Energy Information Administration (EIA) said in an updated forecast Tuesday. The global crude benchmark, which averaged $113 in May, is expected to fall to $97 in 2023,…

Goldman Forecasting $140 Oil for 3Q as Global Supply Pressures Persist

International benchmark Brent crude prices will average $140/bbl between July and September and hang near that level through the first half of next year, analysts at Goldman Sachs Group forecasted. That marks a substantial jump from their earlier call for global prices to average $125 in the third quarter. Prices may need to climb even…

EIA Predicts $103 Crude Later in 2022 as Low Inventories Create Recipe for Volatility

Brent crude oil prices are on track to average $107/bbl in the second quarter and $103 in the second half of this year, with low inventories creating the potential for “significant price volatility,” according to the latest projections from the Energy Information Administration (EIA). Brent spot prices averaged $105 in April, a $13 sequential decrease,…

Earnings Season to Shed Light on Ability of E&Ps to Profit on High Natural Gas, Oil Prices

Lofty energy prices, driven by steady demand and global supply shocks imposed by Russia’s invasion of Ukraine, present U.S. exploration and production (E&P) companies both profit opportunity and potential hazard. As the first quarter E&P earning season gets in full swing over the coming weeks, markets are expected to focus on whether companies are able…

For E&P 1Q Results, All Eyes on Ability to Capitalize on Robust Natural Gas, Oil Prices

Lofty energy prices, driven by steady demand and global supply shocks imposed by Russia’s invasion of Ukraine, present U.S. exploration and production (E&P) companies both profit opportunity and potential hazard. As the first quarter E&P earning season gets in full swing over the coming weeks, markets are expected to focus on whether companies are able…

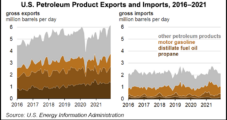

U.S. Oil Production Holds at 2022 High; IEA Says Covid Cuts Global Demand Outlook

Demand for petroleum products dropped last week amid lofty prices while U.S. producers held output at the highest level so far in 2022, the U.S. Energy Information Administration (EIA) said Wednesday. U.S. production for the week ended April 8 held even with the prior week at 11.8 million b/d — after hovering around 11.6 million…

Tight Oil Supply, Russian Invasion Blamed for High Pump Prices, E&P Execs Tell Congress

U.S. oil and natural gas producers don’t set global commodity prices, nor are they attempting to gouge consumers, executives of the leading domestic explorers told Congress last Wednesday. Top executives of BP America Inc., Chevron Corp., Devon Energy Corp., ExxonMobil, Pioneer Natural Resources Co. and Shell USA Inc. discussed the reasons for sustained high prices…

Mexico Fuel Subsidies Seen Cutting into Oil Export Revenues

Mexico President Andrés Manuel López Obrador’s pledge to subsidize gasoline prices could partially negate the windfall of high oil prices for state oil company Petróleos Mexicanos (Pemex), according to a new analysis by Fitch Ratings Inc. Pemex “will benefit from higher oil prices although these pose risks to federal government revenue, since the government has…