A lack of gathering and transmission lines in some parts of the country, particularly those in the Utica and Marcellus shales, are leaving wells shut-in longer, and new data presented Wednesday at an oil and gas conference in Cleveland suggests estimated ultimate recovery (EUR) could be significantly impacted as a result.

NYMEX

Articles from NYMEX

Arctic Blast Pushes Cash Points Higher; Futures Ease Ahead Of Storage Report

Physical natural gas for delivery Thursday gained 12 cents on average Wednesday as traders factored in massive cold front working its way from the Rocky Mountains to the Midwest and points south. At the close, January futures had eased 1.6 cents to $3.960 and February also had shed 1.6 cents to $3.958. January crude oil gained $1.16 to $97.20/bbl.

Industry Briefs

A northeast Ohio company has plans to open one of the state’s first third-party water treatment facilities to process flowback, brine and other wastewater that collects during the drilling process. Ohio favors injection wells to dispose of its oilfield waste, with nearly 98% of all brine water being disposed of in Class II injection wells. Iron Eagle Enterprises LLC, of Liberty Township is the first to receive a third-party permit. Plans call for constructing a 14,000 b/d, or 588,000 gallon, facility in Carroll County, where drilling activities have been robust. The plant is expected to employ as many as 50 people once it’s operational. No completion date has been announced.

Industry Brief

A valve leak that occurred last Friday at a water injection well in Bottineau County, ND, four miles northwest of Maxbass, was reported Monday to the North Dakota Department of Mineral Resources (DMR), oil and gas division. A DMR spokesperson said initial data from Denbury Onshore LLC indicated approximately 50 bbl of oil and 300 bbl of brine were released and recovered on the Fossum B3 water injection well. All fluids were contained to the well site, according to Denbury. The oil and gas division sent a state inspector to the site on Monday.

Western, Midwest Gains Outdistance Weak East; Futures Ease A Penny

Natural gas scheduled for delivery Wednesday rose 2 cents on average in Tuesday’s trading, but the nominal rise masked greater market strength. If volatile points in the Northeast showing multi-dollar declines are subtracted from the figures, the overall gain comes in at 8 cents.

Cold, Demand to Remind Market of Storage Value, Developer Says

Gas price volatility has declined and forward spreads have contracted. With plenty of shale gas around, “who needs gas storage capacity?” is a question on the lips of some. But with the heart of winter fast approaching, attitudes could change, a storage developer told NGI.

Rockies, Midwest Firm Ahead Of Cold; Futures Add 3 Cents

Natural gas for delivery Tuesday added 6 cents on average in Monday’s trading, with Midwest points up a couple of pennies as a major influx of cold air was forecast to slide into the area by midweek. At the close January natural gas futures had gained 3.4 cents to $3.988 and February had risen 2.7 cents to $3.984. January crude oil gained $1.10 to $93.82/bbl.

Texas Freeze Slams Pioneer; Another Wintry Blast On Its Way

A sustained blast of icy weather across Texas last week put a halt to exploration and production (E&P) activity in the Permian Basin, Barnett and Eagle Ford shales, with Pioneer Natural Resources Co. indicating it could be weeks before the full impact is determined.

December Bidweek Traders Riding Full Storage Into the Cold

December bidweek prices showed hefty double-digit gains throughout the country, with NGI’s National Average for the month jumping 24 cents from November to $3.77. Only a single individual point, PG&E Citygate, posted a loss, and advances of double-digits and in some cases, multi-dollars, were registered.

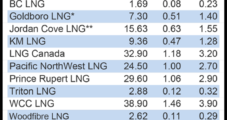

Aurora Enters Canada’s 165 Tcf LNG Export Race

A jumbo Chinese project has raised the volume of supplies earmarked for liquefied natural gas (LNG) exports from proposed Canadian terminals to 165.4 Tcf.