North American natural gas trading has been hijacked by bears, with prices moving lower this week on the back of a healthy supply and storage outlook. The New York Mercantile Exchange (Nymex) futures contract for March is hovering around $2.500/MMBtu, its lowest point in almost two years. Last Friday (Jan. 27), the February Nymex natural…

Natural

Articles from Natural

Natural Gas Futures Rebound Wednesday, but Forecasts Show Unseasonably Mild Weather

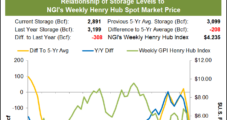

Natural gas futures found fresh footing in positive territory Wednesday, marking the first gain of 2023, amid estimates for a massive storage withdrawal report. At A Glance: BREAKING: U.S. EIA reports bearish 213 Bcf withdrawal from storage for week ending Dec. 30 Warm weather ahead Outlook shows fading heating demand After dropping 48.7 cents in…

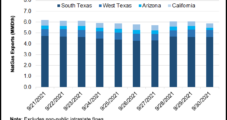

Permian Natural Gas Egress ‘Again Becoming Very Tight’ – Could Mexico and Arizona be Part of Solution?

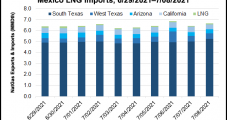

Although Gulf Coast LNG exports are expected to drive the bulk of U.S. natural gas demand growth in the coming years, Mexico and Arizona could play vital roles in easing natural gas takeaway constraints out of the Permian Basin, according to NGI’s Patrick Rau, director of strategy and research. As evidenced by Waha spot prices…

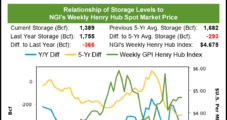

January Natural Gas Futures Claw Out Gain; Cash Prices Strong

Natural gas futures found fresh footing on Tuesday, with the January contract rebounding in its first session as the front month on production drops, rising railroad strike fears and expectations for stronger demand in the month ahead. After sliding 13.4 cents to start the week, January Nymex gas futures settled at $7.235/MMBtu on Tuesday, up…

December Natural Gas Futures Above $6 Handle as Heating Demand Looms

Colder shifts in weather forecasts for mid-November outweighed the potential for increased storage injections, propelling natural gas futures on Monday. After losing ground to close out last week, the December Nymex gas futures contract climbed 67.1 cents day/day and settled at $6.355/MMBtu. January gained 65.4 cents to $6.607. NGI’s Spot Gas National Avg. rose 4.0…

Natural Gas Futures Falter, Ending Furious Rally; Spot Prices Sputter

Natural gas futures retreated Friday, ending five days of frenzied rallying, as markets assessed an increase in production and traders took profits. The June Nymex gas futures contract fell 74.0 cents day/day and settled at $8.043/MMBtu. July dropped 71.3 cents to $8.128. At A Glance: Traders take profits Production inches ahead Demand drivers loom large…

April Natural Gas Futures Surge Well Beyond $5 Threshold

The natural gas futures market shrugged off a bearish government inventory report and flew higher Thursday amid robust demand for U.S. exports, extending a rally to four straight sessions. The April Nymex gas futures contract climbed 16.9 cents day/day and settled at $5.401/MMBtu. May rose 17.2 cents to $5.446. NGI’s Spot Gas National Avg. slipped…

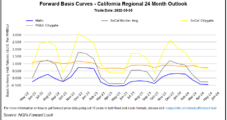

Natural Gas Price Volatility Testing Trader’s Nerves — Mexico Market Spotlight

U.S. natural gas futures facing Mexican buyers and sellers were a roller coaster this week as prices jumped early in the week as October rolled off the board followed by a dive on Wednesday when November took over as the front month. “Markets are very, very nervy,” a Mexico City-based trader told NGI’s Mexico GPI.…

Mexico Natural Gas Market Spotlight: July Imports Slip on Lower Demand

Imports of natural gas from the United States continue to dominate Mexico’s natural gas supply, but they have dropped slightly this month on lower demand. To date this month, Wood Mackenzie reported that Mexico imports from the United States were 6.7 Bcf/d, 2% lower than in June. NGI calculations had the 10-day average through Thursday…

Coronavirus Demand Impacts Still Looming as LNG Exports Rebound; Natural Gas Futures Called Lower

With markets still awaiting more clarity on the potential demand impacts of continued measures to contain the coronavirus outbreak, natural gas futures were trading lower early Monday. The April Nymex contract was down 4.0 cents to $1.564/MMBtu as of around 8:40 a.m. ET.