Gas buyers saw little risk in being caught short of gas Tuesday following the extended Memorial Day weekend and prices fell across the board in Friday’s trading.

Tag / natural gas

Subscribenatural gas

Articles from natural gas

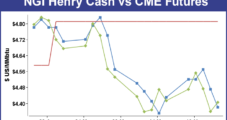

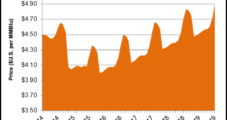

Tight Weekly Ranges Belie Bulls, Bears’ Struggle For Market Control

Winners were able to maintain a slight numerical advantage over losers, but when the averages were tallied the NGI Weekly Spot Gas Average came in at $4.21, down 6 cents for the week ended May 23. Most points were within a dime of unchanged. Of the actively traded points, Tennessee Zone 4 Marcellus made the greatest gains adding 12 cents to $2.24, but Northeast losses were far greater. Weekly quotes on Iroquois Zone 2 fell 37 cents to $4.22 and were closely followed by a decline of 34 cents to $3.54 at the Algonquin Citygates.

Industry Briefs

SixWest Virginia University(WVU) professors have each been awarded $10,000 research grants to study a complex array of shale gas-related issues in the state and across the world. WVU’sNational Research Center for Coal and Energyissued the grants as part of its newly launched WVU Shale Gas Network. The professors will study the potential impacts of shale gas drilling, ranging from heart health and water resources, to the chemical industry and policy development. The projects are aimed at improving the safety and efficiency of shale gas exploration and production, developing new methods for shale gas use in chemical manufacturing and finding out more about the industry’s effects on public health. The Appalachian Basin, Asia, South America and Europe will be among the regions of focus.

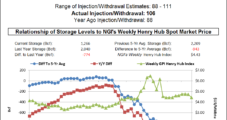

Bulls Circling the Wagons Following EIA Storage Data

Natural gas futures plunged following the release of government storage figures Thursday morning that were on the high side of what the market was expecting.

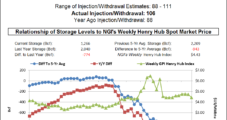

Cash, Futures Decline After Second Triple-Digit Storage Build

Physical gas for Friday delivery retreated broadly in Thursday’s trading. Only a handful of points made gains, and most locations were off a nickel to a dime although some in the Northeast and a few other spots fell by double digits.

BP Taking Macondo Payout Decision to Supreme Court

BP plc will ask the U.S. Supreme Court to review a ruling that would force the company to pay economic damages to businesses that haven’t proved the Macondo well blowout directly caused their losses.

Natural Gas- and Pipeline-Rich Louisiana Picked for Fertilizer Plant

St. Charles Parish in southeast Louisiana has been chosen as the site for a potential $1.2 billion fertilizer plant, thanks to its location in the heart of Gulf Coast natural gas country.

Louisiana Adopts Lawsuit Relief for Oil/Gas Industry

A bill intended to help Louisiana’s energy industry clear the decks of what it considers to be exploitative lawsuits is on its way to the desk of Gov. Bobby Jindal, who is a supporter of the measure. Meanwhile, industry is watching the progress of legislation to quash lawsuits that could put companies on the hook for billions in past coastal damage.

Russia Inks Biggest NatGas Deal in History in Pipeline Agreement with China

In a game-changing transaction Wednesday, China agreed to buy $400 billion of Russia’s natural gas over 30 years, allowing Russia to diversify its market at a time when tensions with U.S. and European nations have escalated.

Industry Briefs

Gulf LNG Liquefaction Co. LLC has beencleared to enter the Federal Energy Regulatory Commission pre-filing process for the proposed addition of natural gas liquefaction and export capability at its existing liquefied natural gas (LNG) import facility in the Port of Pascagoula in Jackson County, MS. The project would also include terminal and pipeline modifications to allow for bidirectional flow of gas to and from the facility. Up to 10.5 million tons/year of LNG would be produced from up to 1.5 Bcf/d of gas. Gulf LNG told FERC it intends to file its application for the project in April 2015. Kinder Morgan Inc. is operator of the terminal and backer of the project along with GE Energy Financial Services. According to Kinder Morgan, a final investment decision on the project is expected during 4Q2016 with the first train potentially operating in late 2019.