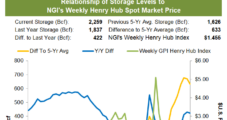

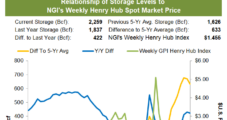

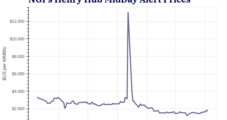

Regional natural gas forward prices advanced during the March 28-April 3 trading period as the start of the spring natural gas storage injection season found market bulls searching for signs of green shoots after a bitter winter. May fixed prices at Henry Hub rallied 12.1 cents to $1.845/MMBtu, setting the pace for similar front-month gains…

Tag / Natural gas futures

SubscribeNatural gas futures

Articles from Natural gas futures

Natural Gas Futures Traders Weighing Mixed Outlook; Steep Spot Discounts — MidDay Market Snapshot

Natural gas futures clawed back some of their recent losses through midday trading Friday as the market continued to mull a mix of fundamental factors, including restrained production, mild weather and plump inventories. Meanwhile, little buying interest for weekend and Monday delivery had cash prices falling hard. Here’s the latest: May Nymex futures at $1.804/MMBtu…

Natural Gas Futures, Cas Prices Slump as Storage Draw Fails to Impress

Natural gas futures fell for a second straight session on Thursday, dragged lower by forecasts for benign weather and government inventory data that showed stout supplies in storage. At A Glance: EIA prints 37 Bcf withdrawal Outlook shifts to injections Weather demand softens Coming off a 2.1-cent loss the prior day, the May Nymex gas…

Natural Gas Futures Flat to Lower Early as Market Mulls Mild Weather, Storage Outlook

Natural gas futures held steady at the front of the curve in early trading Friday as mild shoulder season weather and a somewhat looser-than-expected close to withdrawal season kept the pressure on prices. At around 8:45 a.m. ET, the May Nymex contract was close to unchanged at $1.773/MMBtu. The front month sold off 6.7 cents…

Natural Gas Futures Falter After Storage Print Affirms Lofty Supplies; Spot Prices Slide

Natural gas futures fell for a second straight session on Thursday, dragged lower by forecasts for benign weather and government inventory data that showed stout supplies in storage. At A Glance: EIA prints 37 Bcf withdrawal Outlook shifts to injections Weather demand softens Coming off a 2.1-cent loss the prior day, the May Nymex gas…

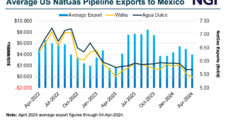

Mexico Natural Gas Market Turns Attention to Elections, Summer Demand – Spotlight

North American natural gas futures got a small boost this week on news of weaker production from U.S. operators, but by mid-week the momentum had fizzled. The May New York Mercantile Exchange gas futures contract posted a second day of losses and lost 6.7 cents on Thursday to settle at $1.774/MMBtu. Mexican imports of U.S.…

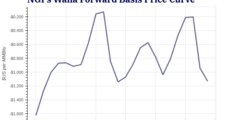

Natural Gas Forwards Entering Shoulder Season in Search of Recovery

Regional natural gas forward prices advanced during the March 28-April 3 trading period as the start of the spring injection season found market bulls searching for signs of green shoots after a bitter winter. May fixed prices at Henry Hub rallied 12.1 cents to $1.845/MMBtu, setting the pace for similar front-month gains across much of…

Natural Gas Futures Floundering After Storage Disappoints; Cash Weaker — MidDay Market Snapshot

Natural gas futures continued to stumble through midday trading Thursday as the market reaffirmed its initial bearish response to the latest government inventory report. Meanwhile, spot prices were down sharply despite unseasonably cool spring temperatures forecast for the Midwest and East through the weekend. Here’s the latest: May Nymex contract down 5.8 cents to $1.783/MMBtu…

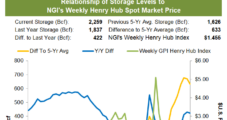

May Natural Gas Futures Fizzle After EIA Prints 37 Bcf Storage Pull

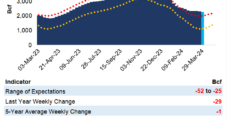

The U.S. Energy Information Administration (EIA) on Thursday reported a withdrawal of 37 Bcf natural gas from storage for the week ended March 29. The result fell just shy of expectations and, with inventories still plump and injections on the horizon, left Nymex natural gas futures under pressure. Ahead of the 10:30 a.m. ET government…

Natural Gas Futures Steady Early as Market Expecting Surplus-Trimming Storage Report

As natural gas traders and analysts prepared to unpack the latest government inventory report for evidence of tightening balances amid fading springtime production, futures hovered close to even early Thursday. The May Nymex contract was trading at $1.837/MMBtu as of 8:41 a.m. ET, off 0.4 cents. Pre-report predictions early Thursday pointed to a notably larger-than-average…