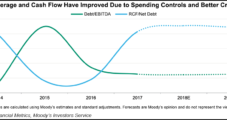

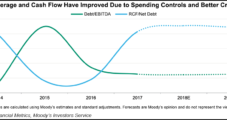

With a “staggering level” of debt maturing in the 2020-2024 time frame and limited access to credit, North America’s exploration and production (E&P) companies, particularly natural gas-focused operators, face an increased risk of default, according to new research from Moody’s Investors Service.

Moody'S

Articles from Moody'S

As DUCs Decline, U.S. Sand Demand Seen Returning, with In-Basin Capacity Outpacing NWS

A fall off in Lower 48 exploration activity has slammed the sand mining sector, but some stability should return this year, according to Moody’s Investors Service.

As DUCs Decline, U.S. Sand Demand Seen Returning, with In-Basin Capacity Outpacing NWS

A fall off in Lower 48 exploration activity has slammed the sand mining sector, but some stability should return this year, according to Moody’s Investors Service.

NGI The Weekly Gas Market Report

Natural Gas Expected to Replace Most Coal Capacity Lost to Shrinking Utility Demand

Amid efforts to reduce greenhouse gas emissions from the U.S. power grid, natural gas-fired generation will replace most of the thermal-coal electric-generation capacity that’s heading toward retirement, according to a new report from Moody’s Investors Service.

PG&E Board Nominees Said to ‘Lack Relevant California Experience’

Chapter 11 bankruptcy-bound PG&E Corp. and utility Pacific Gas and Electric Co. (PG&E) late Wednesday named former public power executive Bill Johnson as CEO along with 10 directors, which it said would create reconstructed oversight at California’s multi-billion dollar combination utility.

NGI The Weekly Gas Market Report

Briefs — WCC LNG

Regulatory preparations have been suspended on WCC LNG Ltd.’s dormant proposal for a jumbo liquefied natural gas (LNG) export terminal on the Pacific coast of British Columbia at Prince Rupert. A year after closing WCC’s office in the northern port, sponsors Imperial Oil Ltd. and ExxonMobil Corp. have withdrawn the application for BC and federal environmental approvals. The project’s 40-year export license from the National Energy Board for up to 4.6 Bcf/d remains valid if deliveries begin before November 2026. The WCC partners have told shareholders that the fate of all their projects depends on evolving market conditions.

Moody’s Says AMLO’s Self-Sufficiency Agenda Creates Risks for Pemex

The next Mexican administration’s focus on energy self-sufficiency could pose risks for national oil company Petroleos Mexicanos (Pemex), according to a recent report by Moody’s Investors Service.

Potential Revamp of Mexico Energy Sector Said Risky for Pemex

The incoming Mexican administration’s focus on energy self-sufficiency could pose risks for national oil company Petroleos Mexicanos (Pemex), according to a recent report by Moody’s Investors Service.

North American E&P Credit Quality Improving, Still Lagging Boom Years

Fundamentals are more robust today, but most North American exploration and production (E&P) companies’ credit metrics are still much weaker than the boom years of 2013-2014, Moody’s Investors Service said Monday.

Moody’s Says Coal Producers Likely to Benefit from Potential Bailout, But Markets Could Suffer

Moody’s Investors Service said owners of coal-fired power plants, as well as domestic coal producers, would likely benefit from a Trump administration proposal to subsidize struggling coal and nuclear power plants, but retail customers could see higher electric bills and wholesale power markets could also be placed at risk.