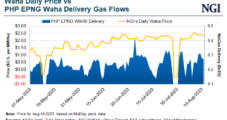

Midstreamer Oneok Inc. hopes to reach a final investment decision (FID) on its proposed 2.8 Bcf/d Saguaro Connector natural gas pipeline later this year. The 155-mile pipeline would transport natural gas from the Waha hub in West Texas to the Mexico border. It would serve the Saguaro LNG export terminal proposed by Mexico Pacific Ltd.…

Midstream

Articles from Midstream

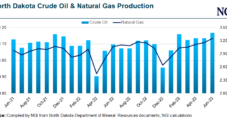

Oil Economics Driving Slow, Steady Natural Gas Production Growth in North Dakota

Production continues to edge upward in North Dakota’s oil and natural gas patch, with total output growing by 3% in June versus May, according to the state’s Department of Mineral Resources (DMR). DMR’s Lynn Helms, oil and gas division director, recently hosted a press conference to discuss the June figures and the outlook for exploration…

Kinetik Posts Record Natural Gas Processing Volumes in Permian Despite Blistering Heat

Permian Basin pure-play Kinetik Holdings Inc., whose midstream operations transport natural gas to Gulf Coast markets and beyond, set a processing record in the second quarter, even as high temperatures stalled some exploration and production (E&P) customer operations. The Midland, TX-based operator was created last year in an all-stock transaction between EagleClaw Midstream and Altus…

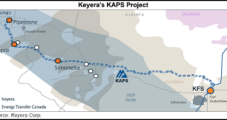

Keyera Overcomes Canadian Wildfire Outages as KAPS Starts Up, Moving Supply from Grand Prairie

The full ramp-up of a dual pipeline to transport natural gas liquids from Canada’s Grand Prairie production area helped improve the bottom line for Calgary-based Keyera Corp. during 2Q2023, even with outages related to the Canadian wildfires. The Calgary-based midstream operator began service in June through the second leg of the Key Access Pipeline System…

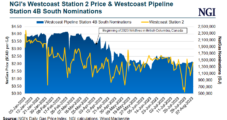

Canadian E&Ps, Pipelines and Utilities Recovering After Fires Scorched 2Q Natural Gas, Oil Output

Canada’s natural gas and oil sector faced daunting challenges during the second quarter because of the still-unfolding wildfire season, but activity overall has recovered, according to some of the top operators. Exploration and production (E&P) companies, midstream operators, oilfield services (OFS) providers and utilities reported big and small impacts to their operations between April and…

Williams CEO Sees Continued Strong Natural Gas Production Ahead of Rising LNG Demand

Midstream giant Williams executives see strong levels of natural gas production enduring as global LNG demand is poised to further mount in coming years. The Tulsa-based company’s chief executive said producers, while trying to contain expenses amid a prolonged bout of low prices, want to maintain output momentum ahead of a years-long expansion of liquefied…

New Midstreamer Voyager Seeking Development Opportunities in Texas, Beyond

Voyager Midstream Holdings LLC is setting its sights on acquisition and development opportunities in the Permian Basin and Eagle Ford Shale, executives of the newly formed independent company told NGI. Armed with an undisclosed initial capital commitment from Dallas-based Pearl Energy Investments, the midstream company is pursuing crude oil, natural gas and produced water infrastructure…

Enterprise Drives Strong Natural Gas Pipeline Volumes, but Low Prices Weigh on Profits

Enterprise Products Partners LP reported company-record natural gas pipeline volumes, accommodating steadily robust production. However, the second quarter top and bottom lines declined amid weakened prices. Still, the Houston-based midstream company continues to expand its infrastructure in the prolific Permian Basin to increase capacity and meet expectations of long-term demand for natural gas, liquids and…

Piñon Midstream Spurring Permian Delaware Expansion for Sour Gas Treatment

Piñon Midstream LLC is undertaking another expansion project to increase the capacity of its Lea County, NM, sour natural gas facility, and may be looking to add interconnects on its natural gas processing delivery pipeline. Piñon is increasing the treating capacity of its Dark Horse Facility, which treats and sequesters sour gas (H2S), as well…

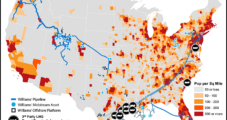

Mexico Nearshoring Opportunity Includes Texas Natural Gas

Mexico is at a pivotal moment as it gears up for an election next year amid a global rearrangement of supply chains. Ensuring reliable and affordable energy is key to the nation’s success, said participants at the Mexico Gas Summit in San Antonio, TX last week. The country needs investment in its natural gas supply…