Over the past two decades, Diversified Energy Co. has grown into a $1.3 billion company that operates 69,000 natural gas wells across the Lower 48, which produce about 106,000 boe/d on average. In fact, the Birmingham, AL-based and London Stock Exchange-listed firm claims it is the largest U.S. gas well operator. “Natural gas will be…

Tag / Midcontinent

SubscribeMidcontinent

Articles from Midcontinent

Devon Holding Lower 48 Oil, Gas Output Flat into 2022, Rewarding Shareholders Instead

Global oil and natural gas demand is forecast to remain tight in the months ahead, but Devon Energy Corp. is holding the line on production, instead looking to reward shareholders. The Oklahoma City-based independent, whose portfolio is concentrated in some of the richest oil and natural gas basins of the country, plans to maintain production…

Continental Takes On Permian Delaware in $3.25B Deal with Pioneer Natural

Continental Resources Inc. is expanding into the Permian Basin through an all-cash acquisition from Pioneer Natural Resources Co. valued at about $3.25 billion. The assets in the Texas portion of the Delaware sub-basin are currently producing 55,000 boe/d with a 70% oil cut. They comprise more than 1,000 total locations, including more than 650 gross…

Devon CEO Not Ruling Out More Acquisitions as Rumors Swirl about Shell’s Permian Assets

It’s already completed a big Lower 48 takeover this year, but Devon Energy Corp. isn’t ruling out making a bid on more oil and natural gas assets, the CEO said Wednesday. Over the last couple of weeks, rumors have swirled that Royal Dutch Shell plc may sell its Permian Basin portfolio, estimated to be worth…

Ovintiv Holding Line on Lower 48 Capex as Raw Materials, Labor Costs Escalate

Ovintiv Inc., whose portfolio stretches from Western Canada to West Texas, is seeing costs for materials and labor rising, but inflationary pressures and capital guidance are being kept in check with operational efficiencies, executives said Wednesday. CEO Doug Suttles, who is retiring, presided over his final conference call on Wednesday, ushering in a new era…

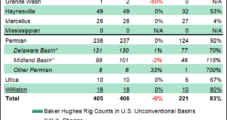

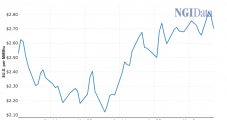

Oil, Natural Gas Rig Tallies Rise as Baker’s U.S. Count Climbs to 484

Amid a ramp-up in both oil- and natural gas-directed drilling, the United States added five rigs to raise its tally to 484 during the week ended Friday (July 16), according to the latest count from Baker Hughes Co. (BKR). Three natural gas-directed rigs and two oil-directed rigs were added domestically during the week. The U.S.…

Cimarex Selling Some Midcontinent Assets to BCE-Mach III, but Region ‘Sustaining’ Part of Portfolio

U.S. independent Cimarex Energy Co. has agreed to sell some of its Midcontinent properties, including a pair of natural gas gathering and processing facilities, to privately held BCE-Mach III LLC for an undisclosed amount. Under the recently signed purchase and sale agreement, the partnership of Houston-based Bayou City Energy Management LLC and Mach Resources LLC…

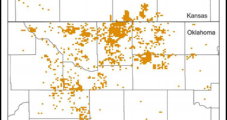

SandRidge Looking for Deals as Midcontinent Activity Shrinks

SandRidge Energy Inc. carried out zero drilling activity on its assets in the Midcontinent and in Colorado last year, causing production to wither, according to its 2020 annual report. The company’s output fell by nearly 25% in 2020 to 8.7 million boe comprising 24% oil, 45% natural gas and 31% natural gas liquids (NGL). In…

Tapstone Energy Wins Chesapeake’s Midcontinent Assets in Bankruptcy Auction

Chesapeake Energy Corp. has sold its massive Oklahoma asset position to Tapstone Energy LLC for $130.5 million. Both Oklahoma City producers reached a deal after Tapstone successfully bid for the assets during a bankruptcy auction last week. Tapstone had been selected as the stalking horse bidder last month, when the U.S. Bankruptcy Court for the…

Chesapeake Cleared by Bankruptcy Court to Sell Midcontinent Assets

A court has authorized Chesapeake Energy Corp. to sell its Midcontinent assets and approved procedures to get the process started. Under an order issued by the U.S. Bankruptcy Court for the Southern District of Texas, Chesapeake has until Oct. 22 to designate a stalking horse bidder that would set the bar for the value and…