November natural gas is set to open 3 cents higher Friday morning at $3.08 as traders see a market feeding off gains made Thursday following the Energy Information Administration storage report. Overnight oil markets fell.

Matthew

Articles from Matthew

Hurricane Matthew Batters Florida’s East Coast; NatGas Demand Drops 0.5 Bcf/d

Hurricane Matthew continued to batter Florida’s east coast Friday, knocking out electricity to hundreds of thousands, resulting in a 0.5 Bcf/d drop in natural gas demand in the state, but the longer-term impact on natural gas facilities seemed slight.

NatGas Cash, Futures Go Their Separate Ways; November Adds 14 Cents

Three-day deals became a tough sell in Friday’s trading as Hurricane Matthew moved up the Florida coast, and gas for weekend and Monday delivery fell by double-digits, although most points declined by a dime or less.

Physical NatGas Beats Resilient Futures; November Up A Penny Despite Bearish EIA Data

Next-day natural gas bounded higher in Thursday’s trading despite the tendency for physical traders to attempt to get deals done ahead of the 10:30 a.m. EDT release of inventory data by the Energy Information Administration (EIA).

Rangebound Market Anticipated; November Called 3 Cents Lower

November natural gas is expected to open 3 cents lower Tuesday morning at $2.89 as forecasts call for warmer than normal temperatures across the nation’s midsection and traders attempt to determine the impact of Hurricane Matthew. Overnight oil markets were mixed.

Eastern Gains Lead NatGas Cash Higher; Late Rally Pushes Futures Up 4 Cents

Physical natural gas for Wednesday delivery moved within a few pennies of unchanged at most market points on Tuesday, although some locations in the East made an attempt to climb out of the sub-dollar doldrums.

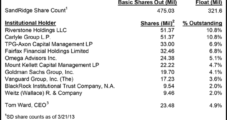

Hedge Fund Forces Power Shift at SandRidge

After months of haggling, hedge fund TPG-Axon Capital, which owns 7.3% of outstanding SandRidge Energy Inc. shares, has gained at least a portion of the changes it had urged at the Oklahoma City-based company, and it stands poised to remove CEO Tom Ward or take control of the board of directors.

BNSF Sees More Crude Traffic, Readies Test of NatGas Locomotives

Crude oil shipments on all U.S. railroads could hit 700,000 b/d by the end of this year, up 40% from current levels, and top 1 million b/d in 18 months, said BNSF Railway Co. CEO Matthew Rose.

New Director Takes Helm at COGCC

Former Colorado Assistant Attorney General Matthew Lepore on Monday took the reins as director of the Colorado Oil and Gas Conservation Commission (COGCC).

People

Matthew R. Simmons, 67, who founded Simmons & Co. International in 1974, died on Aug. 8 in Maine. Simmons founded the Houston-based energy investment bank and had become an industry go-to expert and frequent critic. He routinely filled energy conference halls with his insights and criticism about oil and natural gas issues. Simmons started the investment bank in May 1974 to focus on the oil services industry, and by 1981 the firm employed 13 people. While some financial services firms abandoned the energy sector through the 1980s, Simmons & Co. persevered and began to work on bankruptcy workouts and debt restructurings. In 1995 Simmons & Co. redefined itself to offer “total energy services,” with a focus on companies with natural gas plants, pipelines and other gathering systems, as well as the downstream sector. In 1998 an office was opened in Aberdeen, Scotland. Two years later the firm completed its first investment banking assignment in the exploration and production sector, now a major part of the firm’s business. Simmons was a proponent of the “peak oil” theory; in his book Twilight in the Desert he offered detailed research that he believed indicated that the world was running out of fossil fuels. Simmons retired as chairman emeritus of the bank in June to devote his full time to the Ocean Energy Research Institute, which he founded in 2007. The institute is a think tank and venture capital fund that focused on the challenges of the U.S. offshore renewable energy industry, including wind energy.