Frustratingly low commodities prices continued to exert their force as 2015 wound down, with a majority of the companies participating in NGI’s 4Q2015 Top North American Gas Marketers Ranking reporting lower sales transaction numbers than they did in 4Q2014.

Marketers

Articles from Marketers

Largest NatGas Marketers Lead Trading Decline in 4Q and Full Year 2013

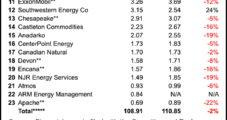

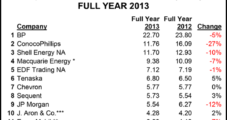

Natural gas marketers continued to report significant declines in sales in the last three months of 2013 compared with 4Q2012, and the top three marketers — BP plc, Shell Energy NA and ConocoPhillips — were among those with the largest declines, according to NGI’s 4Q2013 Top North American Gas Marketers Ranking.

3Q2013 NatGas Marketers Total Plummets 9%; Big Three Lead Decline

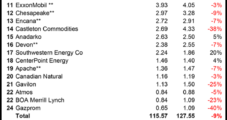

Led by some of the biggest names in the industry, North American natural gas marketers again reported significant sales declines in 3Q2013 compared with 3Q2012, with the top three marketers — BP plc, Shell Energy NA and ConocoPhillips — reporting a combined 7.53 Bcf/d (14.5%) decline, according to NGI’s 3Q2013 Top North American Gas Marketers Ranking.

Energy Firms to Fed: Don’t Exclude Banks from Commodities Markets

“If counterparties, such as banks…begin to disappear, our ability to manage our risk would be seriously impeded,” energy companies told Federal Reserve Chairman Ben Bernanke.

Broad Physical Advance Continues, Yet Futures Slip

Natural gas for Thursday delivery rose 6 cents on average nationally on Wednesday as short-term weather forecasts continued to prove unrelenting in their call for unseasonably warm temperatures. Only a handful of points were in the loss column and many points were up a dime or more. Great Lakes locations were up about 4 cents and Midcontinent locations gained a couple of pennies to a little more than a nickel.

Surging Cash Outdoes October Futures, Which Notch Eight-Week High

Natural gas prices for delivery Wednesday added an average 10 cents in Tuesday’s trading. Strong pricing in the East and Great Lakes as well as a firm screen were able to offset a mixed Northeast and free-falling quotes in the Marcellus, which ratcheted below $1 and in at least two cases, recorded new all-time lows.

Rough Ride in 2Q for North America’s Natural Gas Marketers

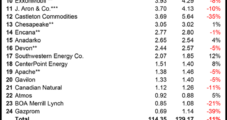

U.S. natural gas marketers were in the midst of a full tactical retreat in the second quarter, with only seven of 24 companies reporting higher numbers compared with the same quarter last year, resulting in an 11% (14.82 Bcf/d) overall decline in gas sales transactions in 2Q2013 compared with 2Q2012, according toNGI’s 2Q2013 Top North American Gas Marketers Ranking.

People

The Natural Gas Supply Association (NGSA), which represents major natural gas producers and marketers, said Greg Vesey, president of Houston-based Chevron Natural Gas, was elected chairman of the association for a two-year term. Vesey is responsible for marketing natural gas to wholesale and large end-use customers throughout North America, as well as contributing to the growth of Chevron’s European gas business. NGSA’s other officers for the 2013-2014 period are Bill Green of Devon Energy, who has been elected vice chairman; and Frans Everts of Shell, who is serving as secretary/treasurer. R. Skip Horvath will continue as president and CEO of the NGSA.

Bears Unfazed by Rockies, Midwest Cold; December Drops by Double Digits

Cash prices overall averaged a 20-cent drop Friday as weather forecasts called for moderation in the Northeast and marketers cited an abundance of available gas. Rockies, the Midwest and the Gulf Coast were all lower. At the close of trading, December futures had dropped 10.5 cents to $3.503 and January was off by 10.3 cents to $3.634. December crude oil gained 98 cents to $86.07/bbl.

Physical Gas Encounters Minor Setback; Futures Dive

Overall, the cash market averaged a 2-cent decline Tuesday, but the Northeast still managed to trade in volatile fashion as traders and marketers continued to adjust to restrictions on Algonquin Pipeline.