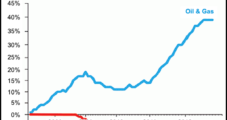

While the number of U.S. jobs has yet to regain pre-recession levels, the oil and natural gas sector has seen a 40% increase in jobs from 2008, with one million Americans now working directly in the industry, and a total of 10 million associated jobs, according to a recent report by the Manhattan Institute for Policy Research.

Manhattan

Articles from Manhattan

Industry Brief

New York’s Con Edison said it will spend about $100 million on new natural gas mains, regulators and other upgrades to its system in several neighborhoods in Manhattan and the Bronx, enabling more customers to convert from heating oil. “Our customers are discovering the economic and environmental benefits of switching from heavy fuel oils to natural gas, and we want to do everything we can to make the conversion process easy for them,” said Nick Inga, director of the utility’s gas conversion group. A New York City environmental regulation phases out the use of No. 6 fuel oil by 2015 and No. 4 fuel oil by 2030. The regulation requires building owners to switch to another heating source, such as natural gas. Although the regulation does not require the phasing out of No. 2 fuel oil, hundreds of No. 2 oil-heated buildings have switched as well to natural gas due to economic benefits, Con Edison said.

New York Would Reap Billions If Frack Ban Lifted, Report Finds

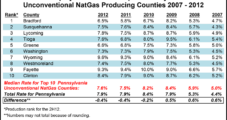

A report by the Manhattan Institute for Policy Research says personal income for the residents of 28 counties in New York that overlay the Marcellus Shale could grow by 15% or more over the next four years, if the state lifts a moratorium on high-volume hydraulic fracturing (HVHF).

Bankruptcy Judge Acts on Calpine’s First Motions in Chapter 11

U.S. Bankruptcy Judge Burton R. Lifland in a Manhattan federal court Thursday acted on Calpine Corp.’s initial motions in the company’s multi-billion-dollar Chapter 11 bankruptcy filing earlier in the week, granting the company’s immediate use of $500 million of some $2 billion debtor-in-possession (DIP) financing and authorizing the company to continue paying employee wages, salaries, and benefits during the court-supervised restructuring. In addition, Judge Lifland set a hearing Jan. 5 on Calpine’s motion to suspend some of its below-market power contracts, two of which are in California, totaling 1,200 MW.

Interim Enron CEO Requests $25M ‘Success Fee’

The firm representing Enron Corp.’s acting CEO on Thursday filed a motion with the U.S. Bankruptcy Court in Manhattan asking for a $25 million “success fee” for guiding the fallen energy giant through its Chapter 11 bankruptcy.

Merrill Lynch Suffers Setback in Legal Battle with Allegheny

U.S. District Judge Harold Baer, Jr. in Manhattan has agreed with Allegheny Energy that its counterclaims against Merrill Lynch should be heard by the court, particularly the charges regarding whether Allegheny was misled when it purchased Global Energy Markets (GEM) from Merrill in 2001 for $490 million and a 2% equity interest in the trading unit.

Merrill Lynch Suffers Setback in Legal Battle with Allegheny

U.S. District Judge Harold Baer, Jr. in Manhattan has agreed with Allegheny Energy that its counterclaims against Merrill Lynch should be heard by the court, particularly the charges regarding whether Allegheny was misled when it purchased Global Energy Markets (GEM) from Merrill in 2001 for $490 million and a 2% equity interest in the trading unit.