Piedmont Natural Gas, a major natural gas distributor based in Charlotte, NC, has signed a 15-year contract with Cabot Oil & Gas Corp. to purchase a “meaningful portion” of its natural gas supplies from the Marcellus Shale beginning in December 2015.

Major

Articles from Major

Gas Pipes Want Assurances on Sharing Info with Generators

A major natural gas pipeline group has called on FERC to provide pipelines with assurance that information shared with power generators to promote reliability will not be a violation of the Natural Gas Act (NGA) or agency regulation, and would not expose pipelines to potential civil penalties in the event that a disclosure would cause economic harm to a power generator.

Info Sharing With Generators May Expose Pipes to Violations, Penalties

A major natural gas pipeline group has called on FERC to provide pipelines with assurance that information shared with power generators will not be a violation of the Natural Gas Act (NGA) or agency regulation, and would not expose pipelines to potential civil penalties in the event that a disclosure would cause economic harm to a power generator.

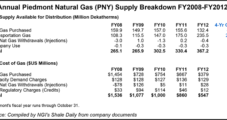

Piedmont Gas Looks to Marcellus for ‘Meaningful Portion’ of Supplies

Piedmont Natural Gas, a major natural gas distributor based in Charlotte, NC, has signed a 15-year contract with Cabot Oil & Gas Corp. to purchase a “meaningful portion” of its natural gas supplies from the Marcellus Shale beginning in December 2015.

Colorado Poised to Make Drilling Rules Mandatory

After relying on industry voluntary actions regarding drilling setback and water sampling approaches, Colorado regulators are poised to establish new mandatory rules covering exploration and production (E&P) companies.

Real-Time Reporting, Record Keeping for Some Swap Transactions Begins

Two major Dodd-Frank Wall Street regulatory reforms — real-time reporting of swap transactions and swap dealer (SD) registration — began last week, the Commodity Futures Trading Commission (CFTC) said.

Real-Time Reporting, Record Keeping for Some Swap Transactions Begins

Two major Dodd-Frank Wall Street regulatory reforms — real-time reporting of swap transactions and swap dealer (SD) registration — began earlier this week, the Commodity Futures Trading Commission (CFTC) said.

South Dakota Joins Push on Drilling Rules

Lacking anything like the Bakken to its north and not seeing a major new play on the horizon, South Dakota oil and natural gas authorities nevertheless have begun the process for upgrading the state’s exploration and production (E&P) regulations, including adding provisions addressing hydraulic fracturing.

California OKs Pipe Plan Limiting Ratepayer Costs

As its first major decision following the San Bruno pipeline failure two years ago, California regulators on Thursday approved a three-year pipeline enhanced safety plan for Pacific Gas and Electric Co. (PG&E) but denied utility ratepayer support for most of the cost of the utility proposal.

Industry Brief

Penn Virginia Corp.’s 40% working interest partner in its Lavaca County, TX, Eagle Ford Shale acreage has elected to go “nonconsent” on the last 17 initial unit wells on the acreage. Penn Virginia said it will seek a partner to acquire the 40% working interest. Of 17 initial unit wells, seven have been drilled, two are being drilled and eight remain to be drilled, the company said. The current working interest partner will have no participatory rights in any subsequent wells drilled in the unit. As a result, Penn Virginia’s net Eagle Ford acreage in Lavaca County will increase from about 9,200 acres to about 13,400 acres upon the drilling of all of the initial unit wells. “We expect that each of the drilling units will support up to an additional four primary development wells after the initial well,” Penn Virginia said. “To date, our Lavaca County wells have generally met or exceeded expectations with average reserves of approximately 500,000 boe and attractive economics.” In October, Penn Virginia acquired about 4,100 net Eagle Ford acres in Gonzales and Lavaca counties for about $10 million. Other nonoperated working interest owners were expected to acquire some of the acreage (see Shale Daily, Oct. 4). One year ago, the company said it was exploring the Eagle Ford with an undisclosed “major oil and gas company” (see Shale Daily, Dec. 21, 2011).