Lagoon Water Midstream on Tuesday said it has closed the acquisition of Midland, TX-based Double Drop Resources, a Permian Basin-focused water management company. The acquisition “significantly expands Lagoon’s operations and establishes it as a multi-basin water management company with a presence in the heart of the Permian,” according to Lagoon, which is backed by Macquarie…

Macquarie

Articles from Macquarie

Macquarie Launches WaveCrest Energy to Develop LNG Markets in Asia, Latin America

An affiliate of Australian investment bank Macquarie Group Ltd. has launched a company to develop and operate liquefied natural gas (LNG) infrastructure projects. WaveCrest Energy LLC would develop, construct, operate and own LNG regasification, power and downstream infrastructure assets. The company initially would primarily serve Latin American and Asian markets to establish and develop demand…

People — Chris Rutherford

Chris Rutherford has been appointed as a managing director at Macquarie Capital to cover upstream oil and gas companies. The former UBS managing director in the firm’s Natural Resources Group will be based in Houston and lead upstream coverage of mergers and acquisitions, as well as debt and equity capital offerings. Macquarie Energy is the No. 2 physical natural gas marketer in North America, according to NGI’s quarterly compilation of the top gas marketers. During 3Q2018, Macquarie’s physical gas transactions in the United States and Canada totaled 12.71 Bcf/d, a 32% increase year/year.

People — Pioneer CEO Dove Retires

Pioneer Natural Resources Co. announced that CEO Timothy L. Dove, who has been with the company for 24 years, would retire immediately. Chairman Scott D. Sheffield is again taking the helm. Sheffield, founding CEO who served from 1997-2016, has been chairman since 1999. Lead director J. Kenneth Thompson has been named chairman. Pioneer in its 4Q2018 report said net income fell by more than half year/year to $324 million ($1.89/share) from $665 million ($3.87). Mark-to-market derivatives gains recorded during 4Q2018, excluding one-time items, put adjusted net profits at $202 million ($1.18). “Tim has expressed his desire to retire and we have mutually agreed that now is the right time,” Sheffield said. “Over the last several years, our industry has changed significantly, and we have become a pure-play Permian company…In the coming weeks, I plan to engage with our employees and shareholders to understand their views on how to expand Pioneer’s industry leadership position.”

NGI The Weekly Gas Market Report

Top North American Natural Gas Marketers Rack Up Fourth Straight Increase in 3Q2018 NGI Survey

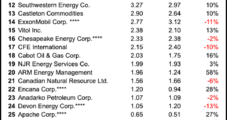

Twenty-five leading natural gas marketers added another 8.04 Bcf/d (7%) to their total sales volumes in 3Q2018 compared with the same period last year, a fourth consecutive quarter with a significant upward trend, according to NGI’s 3Q2018 Top North American Natural Gas Marketers rankings.

NGI The Weekly Gas Market Report

With Supply Finally Leveling Off, Market ‘Looking Pretty Good If You’re A Bull,’ Macquarie Analyst Says

The natural gas market is starting to feel downright bullish, if only because some of the bearish factors weighing down prices the last few years are starting to normalize, according to Macquarie Capital (USA) Global Oil & Gas Strategist Vikas Dwivedi.

Macquarie Strategist Sees Volatile Natural Gas Prices, With $1.50-$6.50/MMBtu Range Possible

Low oil prices could bolster a dry gas strategy, keeping liquids prices low and cutting into associated gas production, just as a raft of new petrochemical, methanol and other manufacturing projects that would increase gas demand are nearing operation.

Macquarie Strategist Sees Volatile Natural Gas Prices, With $1.50-$6.50/MMBtu Range Possible

Low oil prices could bolster a dry gas strategy, keeping liquids prices low and cutting into associated gas production, just as a raft of new petrochemical, methanol and other manufacturing projects that would increase gas demand are nearing operation.

Alberta Changes Well Spacing Regulations

Regulators in Alberta said the province would remove most subsurface well density controls for coalbed methane (CBM) and shale gas, one of several changes announced Thursday for well spacing for conventional and unconventional oil and gas wells.