Canadian Natural Resources Ltd. (CNRL), the nation’s top fossil fuel producer, scooped up 434 square miles of the liquids-rich Montney Shale gas formation in northern British Columbia (BC) with a friendly takeover of Painted Pony Energy Ltd. Painted Pony management recommended stockholder acceptance of CNRL’s cash offer of C$0.69/share ($0.52), or C$111 million ($83.3 million)…

M&A

Articles from M&A

Range Exiting North Louisiana in $335M Deal After Assets Fail to Perform

Range Resources Corp. has announced a deal to divest its Cotton Valley Sands Terryville Complex assets in North Louisiana, reaching an agreement with Castleton Resources LLC for up to $335 million. The deal comes at a low point in the commodity cycle, considering that Range took on the assets in 2016 with the $4.4 billion…

EnerCorp Merging with Pro Oil to Build OFS Business in Lower 48

EnerCorp Engineered Solutions said Monday it is merging with well flow specialist Pro Oil & Gas Services LLC to expand well construction services across North America. EnerCorp, headquartered in The Woodlands near Houston, formerly was EnerCorp Sand Solutions. The oilfield services (OFS) specialist has focused on sand separation technologies, as well as providing ancillary flowback…

Hilcorp Taking Over BP’s Legacy Alaska Upstream Portfolio

Houston’s Hilcorp Energy Co. has completed a takeover of BP plc’s upstream portfolio in Alaska and is nearing a handoff of the midstream unit, allowing the private explorer to become one of the state’s biggest operators. The $5.6 billion deal struck last year with BP hands affiliate Hilcorp Alaska immediate control of BP Exploration (Alaska)…

BP Strikes $5B Deal to Sell Petrochemicals Business to Ineos as Energy Transition Escalates

BP plc on Monday announced it is selling off its substantial petrochemicals business, much of it in the United States, in a $5 billion deal with chemicals giant Ineos Group. The sale, designed as “the next strategic step in reinventing BP,” would strengthen the balance sheet and deliver on the supermajor’s $15 billion total planned…

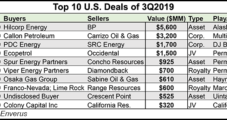

‘Broad Diversity’ Seen in U.S. E&P Dealmaking During 3Q

U.S. exploration and production (E&P) dealmaking has begun, extending beyond the Permian Basin, with the Top 10 deals surpassing $17 billion in the third quarter, Enverus reported Wednesday.

Apache Pursuit Over, Says Anadarko

Anadarko Petroleum Corp. confirmed Wednesday it approached Apache Corp. about a potential buyout, but there currently are no “discussions of substance” after an initial offer was rejected.

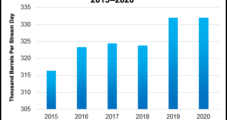

U.S. Deals, Values Decline, Still Lead Global Activity

North America’s $15.9 billion in oil and natural gas merger and acquisition activity led the global markets during the third quarter with a 38% share, but overall U.S. activity and deal values declined year/year, according to PLS Inc. and Derrick Petroleum Services.