Former Rice Energy Inc. CEO Daniel Rice is doubling down on the energy transition with the debut of a second sustainability-focused blank-check firm. Rice Acquisition Corp. II (RAC II) raised $345 million in its initial public offering (IPO), which closed last week. The company, founded and led by Rice, plans to use the proceeds to…

M&A

Articles from M&A

Northern Oil Bolts-On ‘Trifecta’ of Permian Prospects for $102M

Northern Oil and Gas Inc. agreed to spend $102 million to bolt-on prospects in the Permian Basin that cover about 2,900 net acres. The three agreements announced Thursday are from undisclosed sellers for nonoperated assets in Reeves County, TX, and New Mexico’s Lea and Eddy counties. The assets are operated primarily by Colgate Energy LLC,…

Cimarex, Cabot Combination ‘Building an Ark, Not a Party Boat’ in Lower 48 Oil, Natural Gas

Cimarex Energy Co. and Cabot Oil & Gas Corp. on Monday agreed to combine in an all-stock merger, tying together their extensive operations in the Marcellus Shale, Permian and Anadarko basins. Denver-based Cimarex controls 560,000 net acres combined in the Permian and Anadarko, while Houston-based Cabot has 173,000 net acres in the Marcellus. Cabot CEO…

Enerplus Continuing to Build Bakken Stronghold with Hess Purchase

Hess Corp. is selling off some of its Bakken Shale acreage in North Dakota to Calgary-based Enerplus Corp. for $312 million. The deal, set to be completed in May, includes the Little Knife and Murphy Creek acreage. The Hess assets are spread across 78,700 acres in the southernmost portion of its Bakken position. Total net…

Canadian E&P Merger to Create Montney Shale Natural Gas, Condensate Goliath

Canada’s Arc Resources Ltd. and Seven Generations Energy Ltd. (7G) have agreed to merge, a combination that would create one of the top natural gas operators in the country, with output centered in the Montney Shale. Combined production this year is estimated at 340,000 boe/d-plus, including 1.2 Bcf/d of gas and 138,000 b/d of condensate.…

Arc Resources, 7G Combination to Create Montney Natural Gas, Condensate Giant

Canada’s Arc Resources Ltd. and Seven Generations Energy Ltd. (7G) agreed to merge on Wednesday, a combination that would create one of the top natural gas operators in the country, with output centered in the Montney Shale. Combined production this year is estimated at 340,000 boe/d-plus, including 1.2 Bcf/d of gas and 138,000 b/d of…

Calgary’s Whitecap Adds Torc Oil to Takeover List, Building Light Oil Operations

Calgary-based explorers Whitecap Resources Inc. and Torc Oil & Gas Ltd. have agreed to join forces in a merger that combines their light oil-weighted portfolios. The all-stock transaction is valued at around C$900 million ($703 million), including C$335 million of Torc’s net debt. The combination, which is keeping the Whitecap brand, would become one of…

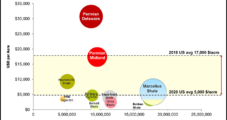

Lower 48 E&P Consolidation Likely to Increase on Lower WTI, Acreage Prices

The average price for U.S. onshore unconventional acreage has declined by more than 70% in the last two years, a precursor to more consolidation through 2022, according to Rystad Energy. The price for Lower 48 acreage fell on average to $5,000/acre this year from $17,000 in 2018, the result of lower West Texas Intermediate (WTI)…

Bonanza Creek, HighPoint to Merge, Creating Powerhouse DJ E&P

Denver-Julesburg (DJ) Basin pure-plays Bonanza Creek Energy Inc. has agreed to merge with Colorado rival HighPoint Resources Corp. in a $376 million transaction that would combine their Weld County acreage and production. On a pro forma basis, Bonanza Creek would have 206,000 net acres in Weld County. All the acreage would be unincorporated and “not…

Liberty Oilfield Finds Opportunities with Haynesville Entry, OneStim Takeover

Denver-based Liberty Oilfield Services Inc. proved the contrarian during the third quarter, and it appeared to pay off, as it acquired a top-tier pressure pumping business, gained entry into the gassy Haynesville Shale, and un-furloughed all of the employees who were sent home last spring in anticipation of brighter days ahead. Revenue jumped 67% from…