While low commodity prices continued to offset significant well productivity improvements, senior executives at EOG Resources Inc. touted extraordinary production and efficiency gains in 3Q2016 and talked bullishly about the rest of the year and their company’s prospects in the 2017-2020 period, with a new focus on premium well locations centered in the Delaware Basin in the Permian.

Locations

Articles from Locations

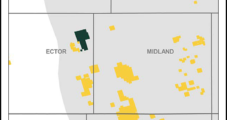

Concho’s $1.6B Deal in Permian Boosts Midland Position

Permian Basin pure-play Concho Resources Inc. agreed Monday to pay $1.625 billion in cash and stock to Reliance Energy for 40,000 net acres in the Midland sub-basin.

Energen to Boost Capital Spending, Permian DUCs

Energen Corp. has completed its transition to a pure-play Permian Basin explorer and has turned its focus to building an inventory of drilled but uncompleted (DUC) wells in the Delaware sub-basin.

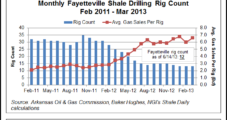

The Fayetteville Shale is Dry, But It’s Hardly Dried Up

“We have thousands and thousands of well locations,” he said at the UBS Global Oil and Gas Conference. “We’ll be drilling at this pace for many years to come, assuming the [Nymex] strip pricing that we have today. We do plan to drill close to 400 wells this year and that certainly, of all of our operations, can flex more than any others as we need to respond to gas prices, one way or the other [see Shale Daily, May 24].”

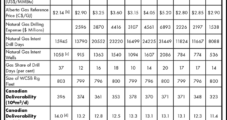

U.S. Shales Putting Canadian NatGas Producers ‘In A Holding Pattern’

While natural gas prices have recovered to nearly $4/MMBtu, the National Energy Board (NEB) said Thursday that Canadian natural gas producers are undertaking minimal natural gas drilling as current prices do not cover the full costs of developing most natural gas prospects and U.S. shale development continues to displace Canadian gas exports.

North Dakota Production, Permitting Up; Flaring Down

After a short-lived lull in late fall, North Dakota’s oil and natural gas production set new records at the end of last year, and the issuance of new drilling permits in January surged, the state’s Department of Mineral Resources (DMR) reported Friday.

Eastern Points Weaken as Power Prices Tumble; Futures Stumble Again

Physical natural gas prices continued their broad retrenchment Thursday with New England and Mid-Atlantic locations continuing their dollar-plus declines. Pipeline delivery points servicing New York and Boston were particularly hard hit, and on average the market fell about a quarter. Take away the Northeast and the overall average drops to a 12-cent decline. February futures fell 3.5 cents to $3.198, and March shed 4.1 cents to $3.214. February crude oil lost 20 cents to $92.92/bbl.

Legacy Reserves Expands Play in Permian

Expanding its assets in an area of its primary focus, Midland, TX-based Legacy Reserves LP said Wednesday it has agreed with Concho Resources Inc. to buy $520 million of Concho’s holdings in the Permian Basin. Legacy said it hopes to close the deal before the end of this year.

Strong Northeast Offsets Soft Midcontinent; Futures Narrowly Mixed

Cash prices overall surged 7 cents higher on average Wednesday as monster gains posted at Northeast locations were more than able to offset a slumping Midcontinent. At the close of futures trading December had inched higher by one tenth of a cent to $3.692 and January had eased four tenths of a cent to $3.820. December crude oil gained 56 cents to $86.24/bbl.

Cash, Futures Dance Higher Despite Waffling Weather Outlooks

The overall cash market advanced another 6 cents on average with only a minority of points in the loss column and some locations sporting double-digit gains. Rockies and northern California points were strong as well as the Gulf Coast and the Midcontinent. Much to the delight of market technicians, futures put in a new high, and at the close November was 3.0 cents higher at $3.617 and December had added 4.3 cents to $3.947. November crude oil followed slumping equity markets and dropped $2.05 to $90.05/bbl.