Tradition Midstream LLC said it has secured $100 million in equity financing to develop infrastructure across North America, with an initial focus on unconventional plays in Texas, Oklahoma and Louisiana.

Level

Articles from Level

Pipeline Capacity Market More than Doubles

The volume of natural gas pipeline capacity changing hands among the 20 leading trading companies during 2012 was up 123% over the 2011 level, exceeding 14.8 Bcf/d and marking the third consecutive annual increase, Capacity Center said last week.

Released Pipeline Capacity Market Grew Again in 2012

The volume of natural gas pipeline capacity changing hands among the 20 leading trading companies during 2012 was up 123% over the 2011 level, exceeding 14.8 Bcf/d and marking the third consecutive annual increase, Capacity Center said Monday.

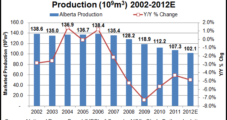

Alberta’s Natural Gas, Oil Shale Potential Said to Be Colossal

After more than a century of production from conventional pools, astronomical volumes still await the new methods of extracting natural gas and oil from Alberta’s shale, according to provincial earth scientists.

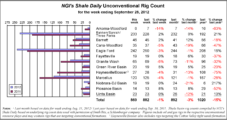

Oil-Gas Lines Blurred As Unconventional Rig Count Declines

Unconventional oil and gas drilling within the 13 plays tracked by NGI’s Shale Daily Unconventional Rig Count dropped by a combined 13 rigs, or 1%, from the previous week to 869 rigs for the week ending Sept. 28. While some of the plays reporting increases or declines in activity were to be expected, others came as a bit of a surprise.

Shale Driving Natural Gas Production to Record Highs, EIA Says

Domestic natural gas production will be at an all-time high this year and is expected to break that record for a third consecutive year in 2013, thanks in large part to the nation’s booming shale plays, the U.S. Energy Information Administration (EIA) said in its Short Term Energy Outlook for September.

NGSA Says Threshold for Public Utility Swaps Favors Banks

The Commodity Futures Trading Commission’s $25 million swaps threshold level for trades involving “special entities,” such as publicly owned utilities, will drive non-bank firms out of the natural gas and electricity markets, leaving trading to big banks like J.P. Morgan, Bank of America and Goldman Sachs, said a major producer group Monday.

NOV Shopping Spree Continues with $2.5B Robbins & Myers Deal

National Oilwell Varco Inc. (NOV), which this year has completed six acquisitions worth $2 billion, on Thursday continued its shopping spree with a $2.5 billion cash offer for Texas operator Robbins & Myers (R&M). The deal would mark NOV’s biggest single acquisition since 2008, when it paid $7.7 billion to buy Grant Prideco.

Forest Plans to Go It Alone in Eagle Ford

Despite previously announced intentions to find a partner to help develop its Eagle Ford Shale acreage, Denver-based Forest Oil Corp. said it has identified a “go-it-alone plan that is attractive to the company.”

Court Remands Colorado Drilling Plan to BLM

In a decision in which both sides are claiming victories of sorts, a federal district judge in Denver on June 22 ordered the federal Bureau of Land Management (BLM) to review and revise its drilling plan for the Roan Plateau in western Colorado where one operator has plans to drill thousands of natural gas wells.