Texas banned local and state government entities from holding stakes in 10 financial companies and nearly 350 investment funds for allegedly boycotting the oil and natural gas industry. Texas Comptroller Glenn Hegar on Wednesday posted a list of companies and funds that his department determined had shunned oil and gas companies as part of a…

Lending

Articles from Lending

Amid Robust Global Energy Demand, Some Banks See Enduring Natural Gas, Oil Lending Opportunities

Regional banks that lend into the oil and natural gas sector say they are increasingly active as producers borrow to invest in growth amid enduring strong demand for fossil fuels. To be sure, national banks such as JPMorgan Chase and Well Fargo & Co. have pulled back on oil and gas lending amid pressure from…

Regional Banks Sound Upbeat Tune on Lending to Natural Gas, Oil Producers

Regional banks that lend into the oil and natural gas sector say they are increasingly active as producers borrow to invest in growth amid enduring strong demand for fossil fuels. To be sure, national banks such as JPMorgan Chase and Well Fargo & Co. have pulled back on oil and gas lending amid pressure from…

Oil, Natural Gas Lenders Optimistic on 2022 Growth, Cautious Long Term

Banks that actively lend to the oil and natural gas sector are upbeat about strong commodity prices and rising production activity that necessitate new and expanded exploration and drilling projects – and financing to make it happen. Some are reporting loan growth as a result. Others look for increased lending to develop as the year…

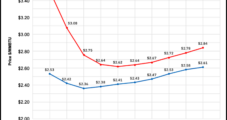

Energy Banks Forecasting Higher Natural Gas, Oil Prices in Welcome Trend for E&P Borrowers

Banks that lend to natural gas and oil producers have substantially raised their price expectations for both commodities, according to the latest biannual Energy Bank Price Deck Survey conducted by Haynes and Boone LLP. The law firm conducts spring and fall editions of the survey each year to capture the expectations of energy banks for…

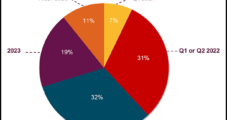

U.S. Oil, Natural Gas Producers Seen Having More Access to Capital This Fall

Exploration and production (E&P) companies that work in the United States are expected to have more reserve-based lending (RBL) capital available to them this fall versus last spring, according to the latest biannual survey conducted by Haynes and Boone LLP. The law firm conducts surveys ahead of each fall and spring redetermination season for RBL,…

PE Funding Filling Void in North America E&P as Public Operators Stay Disciplined

Private equity (PE) continues to pour into the North American oil and natural gas patch amid higher commodity prices and capital discipline by publicly traded companies. Privately held exploration and production (E&P) firm Sabalo Energy II said Wednesday it has closed a $300 million equity commitment from EnCap Investments LP. The objective “is to build,…

Futures Still Knocking on $4 Door as Uptick Continues

October natural gas futures continued to inch higher Wednesday, lending more credibility with each passing day that the market’s seasonal low is already in the books. The prompt-month contract breached psychological resistance at $4 for a second session in a row before closing at $3.995, up 2.9 cents from Tuesday’s finish.

Rebound Falters as Futures Finish Virtually Unchanged

Lending some credibility to Monday’s bullish bounce, October natural gas futures made a higher low on Tuesday but failed to tack on even 1 cent to the advance. The prompt-month contract added four-tenths of a penny to close Tuesday’s regular session at $3.816.

Columbia Pipes Hit with $1M Penalty, $9M Disgorged Profits

FERC last Thursday ordered Columbia Gas Transmission to disgorge $9 million in unjust profits for alleged violations of its parking and lending (PAL) service tariff between 1998 and 2003, and directed Columbia Gas and sister pipeline Columbia Gulf Transmission to pay a civil penalty of $1 million for violations related to their nominations and discount posting practices.