The leading California state lawmakers bird-dogging proposals to stiffen the state’s oversight of hydraulic fracturing (fracking) brought a new issue to the table — acidization to unlock Monterey Shale oil deposits — during a state Senate Natural Resources and Water Committee hearing last month in Sacramento .

Leading

Articles from Leading

Sinopec Claims Half-Stake in Chesapeake’s Mississippian Lime

Chesapeake Energy Corp. has begun operating its 850,000 net acre leasehold in the Mississippian Lime jointly with China’s Sinopec International Petroleum Exploration Corp. after the duo completed a $1 billion-plus joint venture (JV) agreement.

CNG ‘Moving on Up’ with Westport/Clean Energy Deal

A global leader in natural gas engines, Vancouver, BC-based Westport Innovations Inc. on Friday said it has acquired a leading conversion company, BAF Technologies Inc., from Clean Energy Fuels Corp., the California-based natural gas vehicle (NGV) fueling company. Westport secured the deal with $25 million worth of its stock.

NGVs Revved Up with Westport/Clean Energy Deal

A global leader in natural gas engines, Vancouver, BC-based Westport Innovations Inc. last Friday said it has acquired a leading conversion company, BAF Technologies Inc., from Clean Energy Fuels Corp., the California-based natural gas vehicle (NGV) fueling company. Westport secured the deal with $25 million worth of its stock.

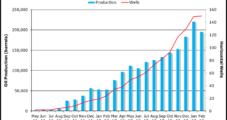

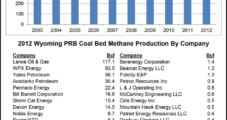

Shale Gas Growth Cited in Wyoming CBM Plant Closing

Eastern shale gas production growth has trumped Wyoming Powder River Basin (PRB) coalbed methane (CBM) as Calgary-based global energy processor Enerflex Ltd. said Thursday it is closing its Casper natural gas compression and processing plant, affecting 89 workers.

Centrica Taking Bet on UK’s Shale Gas Resources

The UK’s leading energy retailer, Centrica, is taking a bet that shale gas resources in the country’s Bowland Basin are the real deal after making a hefty commitment in explorer Cuadrilla Resources Ltd.

Midwest Buyers Navigate Tricky Market; Futures Gain A Dime

Natural gas cash prices on average rose 4 cents in Tuesday’s trading with gains in the Plains, Texas and eastern points leading the march higher. Wild and wacky weather conditions have proved a challenge to cash buyers, who are now devoid of much of their baseload and are at times having to dip into storage and pay penalties. At the close of futures trading, June enjoyed a bump up to $4.025, a gain of 10.0 cents, and July had risen 9.7 cents to $4.068. June crude oil fell 96 cents to $94.21/bbl.

Continental Resources Railing Bakken Crude East

Crude oil from the Bakken Shale will be Delaware-bound under an agreement between leading Bakken producer Continental Resources Inc. and PBF Energy Inc. Crude is to be delivered by rail to PBF’s double-loop track at its refinery in Delaware City.

GE Adds Drilling Heft with Lufkin Takeover

General Electric (GE) on Monday said it would pay $3.3 billion to buy Lufkin Industries Inc., a leading provider of artificial lift technologies for the oil and gas industry.

Industry Briefs

Major environmental groups leading opposition to the northern portion of the proposed $7 billion, 1,700-mile Keystone XL oil pipeline project from Alberta to refineries in the Gulf of Mexico region lashed out at the U.S. State Department last Friday for not making public the comments being collected on the project’s draft supplemental environmental impact statement (see Shale Daily, March 4). Effectively, the only way to hear and respond to public comments on the draft study will be at a hearing scheduled for April 18 in Grand Island, NB, said a Friends of the Earth spokesperson, calling the move “unusual.” This is prompting the foes of Keystone XL to claim the State Department is violating public transparency practices followed by other federal agencies regarding draft environmental studies. The stakeholders are in the middle of a 45-day comment period on the proposed northern portion of TransCanada Corp.’s controversial tar sands oil pipeline from Western Canada to Cushing, OK.