At a time when the oil and gas industry contends it is reducing methane emissions, the issue has become a topic of debate during this year’s midterm election in New Mexico.

Juan

Articles from Juan

WPX Exits San Juan with $700M Sale of Gallup Play

WPX Energy Inc. agreed Monday to sell off its final holding in the San Juan Basin, the Gallup play, for $700 million.

WPX Expands San Juan Leasehold

WPX Energy Inc., which has eschewed its natural gas-heavy portfolio for onshore oil prospects, has added 14,300 net acres in the San Juan Basin’s Gallup formation to its portfolio.

WPX Expands San Juan Leasehold

WPX Energy Inc., which has eschewed its natural gas-heavy portfolio for onshore oil prospects, has added 14,300 net acres in the San Juan Basin's Gallup formation to its portfolio.

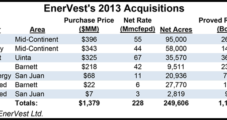

EnerVest ‘s $1B/Year Asset Acquisition Strategy Continues in 2013

EnerVest Ltd. reported Monday that it is on target to clear more than $1 billion in oil and natural gas asset acquisitions within the United States for the fourth year in a row. In 2013 the company is adding to its Midcontinent, Barnett Shale and San Juan Basin acreage, in addition to snapping up its first piece of the Uinta Basin in Utah.

Encana Bets Big On Tuscaloosa Marine Shale

Encana Corp. has about 50 billion bbl of oil in place in its five largest liquids plays, according to Eric Marsh, executive vice president. Earlier this month at Barclays CEO Energy/Power Conference, the Tuscaloosa Marine Shale (TMS) was at the top of his list.

QEP Beefs Up Bakken/Three Forks Acreage in Deals Totaling $1.38B

Continuing its strategy of increasing its acreage in the liquids-rich Bakken Shale and Three Forks Formation, a QEP Resources Inc. subsidiary has entered into two deals with multiple sellers to acquire “significant crude oil development properties” in the Williston Basin for an aggregate purchase price of close to $1.38 billion.

ConocoPhillips Testing San Juan Basin’s Mancos Shale

ConocoPhillips has begun initial development on the “potentially impactful” Mancos Shale in the San Juan Basin, which has the potential to be a producer “for years and years,” CEO Ryan Lance said Wednesday.

Industry Briefs

ConocoPhillips expects its 1Q2008 production to be “slightly below” 1.8 million boe/d following an unplanned shutdown at a nonoperated gas processing plant in the San Juan Basin, which was complicated by cold weather. Output in the final quarter of 2007 was 1.84 million boe/d. The Houston-based major issued an interim update ahead of the April 24 scheduled release of quarterly results. The producer noted that in the first three months of this year, the average price of natural gas climbed 19% from the same period a year ago while crude oil prices surged 69%. Henry Hub first-of-month prices in 1Q2008 averaged $8.03/Mcf, compared with $6.77 in 1Q2007. Gas prices in 4Q2007 averaged $6.97/Mcf. Realized domestic refining and marketing margins for 1Q2008 are expected to be “significantly lower” than margins in 4Q2007 because of the absence of a quarterly inventory benefit, higher crude costs relative to benchmarks and lower margins. Conoco said the prices for its “secondary products,” such as fuel oil, natural gas liquids and petroleum coke “did not increase in proportion to the cost of the feedstocks to produce them.” Debt balance for the major was estimated to be about $21.5 billion at the end of March. Stock repurchases in the first three months of this year were estimated at $2.5 billion.

Processor Outage Crimps ConocoPhillips 1Q Output

ConocoPhillips expects its 1Q2008 production to be “slightly below” 1.8 million boe/d following an unplanned shutdown at a nonoperated gas processing plant in the San Juan Basin, which was complicated by cold weather. Output in the final quarter of 2007 was 1.84 million boe/d.