EQT Corp. is accelerating a plan to address shareholder concerns that the stock is trading at a discount to overall value, announcing that a board committee would make recommendations by the end of March.

Jana

Articles from Jana

Brief — EQT Corp.

EQT Corp. investor Jana Partners LLC continues to lobby against the company’s proposed $8 billion acquisition of Rice Energy Inc. In another letter to EQT’s board of directors, Jana founder Barry Rosenstein said management “conjured up dubious additional synergies” to help sell the acquisition to shareholders during its second quarter earnings call. Rosenstein previously wrote the board to say EQT’s deal to buy Rice would cost too much and said the original $2.5 billion of estimated cost synergies would be eroded by the premium. EQT management said during the call that if it acquires Rice, longer laterals, administrative savings, buying power and marketing optimization, among other things, could create up to $7.5 billion in synergies. Jana, which owns nearly 6% of EQT’s shares, said many could be worth nothing at all or achieved without the acquisition. Jana instead wants EQT to separate its upstream and midstream businesses.

Briefs — EQT Corp.

EQT Corp. investor Jana Partners LLC continues to lobby against the company’s proposed $8 billion acquisition of Rice Energy Inc. In another letter to EQT’s board of directors, Jana founder Barry Rosenstein said management “conjured up dubious additional synergies” to help sell the acquisition to shareholders during its second quarter earnings call. Rosenstein previously wrote the board to say EQT’s deal to buy Rice would cost too much and said the original $2.5 billion of estimated cost synergies would be eroded by the premium. EQT management said during the call that if it acquires Rice, longer laterals, administrative savings, buying power and marketing optimization, among other things, could create up to $7.5 billion in synergies. Jana, which owns nearly 6% of EQT’s shares, said many could be worth nothing at all or achieved without the acquisition. Jana instead wants EQT to separate its upstream and midstream businesses.

Activist Investor Wants EQT, Rice Energy Merger Scrapped

EQT Corp. investor Jana Partners LLC wants the producer to scrap its multi-billion dollar agreement to acquire Rice Energy Inc. and instead pursue the separation of its upstream and midstream businesses, which the hedge fund believes would create substantially more value for shareholders.

Apache Pressured to Sell Off International Portfolio, Focus Strictly on U.S. Onshore

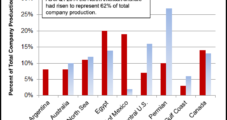

Jana Partners LLC now holds an estimated $1 billion-plus stake in Apache Corp., leverage that the activist hedge fund wants to use to pressure the super independent to sell off all of its international holdings, including in Canada, to focus exclusively on U.S. onshore opportunities.

QEP Midstream MLP Not Enough, Says Shareholder

Activist shareholder Jana Partners LLC this week urged QEP Resources Inc. to break up, claiming that “numerous partners” are interested in a transaction that would create a standalone midstream business.