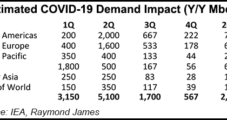

The impact of Covid-19 on pressuring U.S. natural gas prices remains a wildcard, but supply/demand changes point for the strip to move lower this year before 2021 ushers in “extremely bullish” prices, Raymond James & Associates Inc. said Monday.

James

Articles from James

NGI The Weekly Gas Market Report

Raymond James Sees WTI Falling into $20s in 2Q on Covid-19, Price War

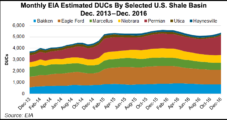

Extraordinary measures are continuing to slam the oil and gas markets, as more North American producers, including EQT Corp. and EOG Resources Inc., are announcing cuts to spending while oil prices — and demand — are slaughtered.

Lower 48 Well Productivity Sputters in 2019 as Decline Curve ‘Steeper Than We Thought’

Well productivity in the Lower 48 jumped in 2018, but output last year appeared to slide, implying the decline curve may be steepening relative to years’ past, according to Raymond James & Associates Inc.

Transco Files For Lateral to Supply Proposed Methanol Plant in Louisiana

Transcontinental Gas Pipe Line Co. LLC (Transco) submitted an application to FERC Monday for a certificate of public convenience and necessity for its St. James Supply Project, which would supply natural gas to a proposed methanol plant in Louisiana.

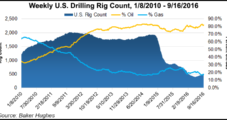

Onshore Rig Count On Track to Double? E&P Cash Flow Rising with Activity, Says Raymond James

U.S. producers may have enough cash flow this year to double the onshore rig count from current levels, Raymond James & Associates Inc. said Monday. The only thing standing in their way could be a lack of pressure pumping equipment.

U.S. E&Ps Shifting from Thrift to ‘Massive’ Capex Surge, Says Raymond James

The domestic oil and natural gas industry likely will see “massive” cash flow increases over the coming years, as the two-year mentality to shrink rapidly shifts back to growth.

‘Economics Will Eventually Win Out’ For Pipelines Facing Delays, Analysts Say

When it comes to the recent string of negative headlines for midstream projects facing opposition and delays, Raymond James & Associates Inc. said this week it thinks market fundamentals “and straightforward economics will eventually win out.”

U.S. E&P Cash Flow, Spend Trending Much Higher in 2017, Says Raymond James

U.S. exploration and production (E&P) cash flow generation and oilfield spending on drilling and completions have bottomed, no matter what direction oil and natural gas pricing goes in 2017, Raymond James & Associates said Monday.

Depleted Frack Capacity to Cap U.S. Rig Count at 800 in 2017, Says Raymond James

Pressure pumping attrition, brought about by financial stress on oilfield operators and equipment wear and tear likely will constrain the U.S. rig count into 2017, Raymond James & Associates said Monday.

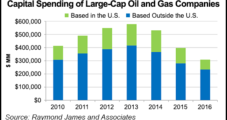

Raymond James Says E&Ps Focused on Lower 48 Cutting Capex Most

The biggest capital spending reductions in the global oil and natural gas industry are — no surprise — led by producers whose assets are concentrated in the Lower 48 states, Raymond James & Associates Inc. said Monday.