Lower 48-focused Kodiak Gas Services LLC, the largest privately owned natural gas contract compression company in the country, is preparing to go public with an offering that could fetch a valuation of nearly $1.7 billion. Based in Montgomery, TX, about 50 miles northeast of Houston, Kodiak is proposing to sell 16 million shares through an…

Ipo

Articles from Ipo

Adnoc Natural Gas, LNG IPO Seen as ‘Highly Feasible’ Amid Broader Expansion Plans

Abu Dhabi National Oil Co. (Adnoc) is advancing plans to launch an initial public offering (IPO) that would combine the United Arab Emirates’ (UAE) largest natural gas companies as part of a broader plan aimed at attracting more foreign investors and funding for long-term projects. “Natural gas will be a critical fuel in the energy…

Excelerate Energy Makes Waves with First Major LNG IPO Since Ukraine War Began

Liquefied natural gas (LNG) infrastructure company Excelerate Energy Inc. announced Wednesday it could net $361.9 million with the first major initial public offering (IPO) from a U.S. LNG company since the war in Ukraine began. The Woodlands, TX-based firm said Tuesday that it priced 16 million shares at $24/share. The offering came in at the…

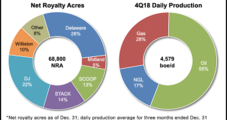

Vine Energy Going Public, Says Haynesville ‘Critical’ to Future Natural Gas Demand

With its focus trained on fulfilling natural gas demand on the Gulf Coast and beyond, Haynesville Shale pure-play Vine Energy Inc. is preparing to go public. The Blackstone Group LP-backed private on Tuesday priced an initial public offering (IPO) for 18.75 million common shares at $16-19 each. At those prices, Vine could raise $328 million…

Golar Affiliate Files for IPO to Buildout LNG Import Infrastructure

Golar LNG Ltd. said a joint venture it formed with New York City-based Stonepeak Infrastructure Partners has filed for an initial public offering with the U.S. Securities and Exchange Commission (SEC) to better build out import terminals and downstream natural gas assets across the world. Hygo Energy Transition Ltd., formerly known as Golar Power Ltd.,…

Brigham Minerals Files IPO, While BJ Services Pulls Offering

Brigham Minerals Inc., a company with a long lineage of successful Lower 48 operators, is planning to launch an initial public offering (IPO) to raise up to $100 million.

Vista’s Goal: ‘Latin American Champion’ for Oil, Gas Sector, Says CEO

Mexico’s first independent oil and gas company since energy reforms were instituted four years ago began trading Friday following a successful public offering for $650 million.

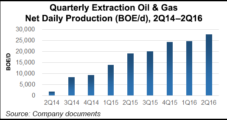

Extraction, First E&P Launch in Two Years, Soars Early in Nasdaq Debut

Denver-based Extraction Oil & Gas LLC, the first U.S. exploration and production company to go public in two years, climbed 15% in its debut on Nasdaq Wednesday after pricing above expectations.

Briefs — Rangeland, Noble Midstream

Rangeland Energy of Sugar Land, TX, has formed a subsidiary to pursue midstream opportunities in Western Canada. Rangeland Midstream Canada Ltd. is led by Briton Speer, who joined Rangeland Canada in August as vice president, business development. Headquartered in Calgary, Rangeland Canada’s expertise includes gathering, compression, treating, processing and storage services for natural gas, crude oil and natural gas liquids. Rangeland Energy was formed in 2009 to develop, acquire, own and operate midstream infrastructure. The company is focused on emerging shale plays across North America with an emphasis on the Permian Basin’s Delaware sub-basin in West Texas, the U.S. Gulf Coast and Canada. Speer most recently was vice president of business development for DK Canada Energy ULC, a subsidiary of Delek US Holdings Inc. Prior to DK Canada, he worked for eight years at Pembina Midstream LP. Separately, Rangeland Energy said its RIO Pipeline has entered commercial service to transport crude oil and condensate from the Delaware (see Shale Daily,April 12). The 110-mile, 12-inch diameter pipeline originates at the RIO State Line Terminal in Loving County, TX, a gathering hub at the Texas-New Mexico border in the heart of the Delaware with tankage and truck unloading facilities. The pipeline has the capacity to transport more than 125,000 b/d to Rangeland’s Geneva and Zurich terminals in Midland, TX.