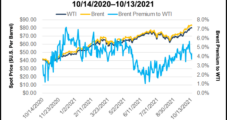

While strong, consumption of oil proved uneven through the first nine months of 2021, interrupted by outbreaks of the coronavirus Delta variant. This led the world’s largest cartel of crude producers to downgrade its demand outlook for the full year. The Organization of the Petroleum Exporting Countries (OPEC), however, said Wednesday that lofty natural gas…

Tag / Inventories

SubscribeInventories

Articles from Inventories

With Imports Up, U.S. Crude Inventories Climb a Second Week

Domestic petroleum demand rose last week, but strong crude production and imports ended up driving U.S. inventory gains for a second straight week, the Energy Information Administration (EIA) said. EIA’s Weekly Petroleum Status Report, released Wednesday, showed production climbed to 11.3 million b/d for the week ended Oct. 1, up from 11.1 million b/d the…

October Natural Gas Bidweek Prices Spike Amid Global Supply Trouble, Potential for Winter Crisis

Natural gas prices soared in October bidweek trading as markets fixated on a potential global supply squeeze and expectations of strong demand for U.S. exports of liquefied natural gas (LNG) by winter. NGI’s October Bidweek National Avg. spiked $1.355 month/month to $5.495/MMBtu. A year earlier, when the coronavirus pandemic weighed heavily on demand, the October…

Stockpiles of U.S. Crude Mount; IEA Says Global Oil Demand Recovery Gradual Through 2023

U.S. oil inventories increased for a third-consecutive week as demand for travel fuels remained light and as refinery activity, while increasing, held far below capacity following the blast of winter weather that froze the Texas energy grid in February. Domestic commercial crude inventories for the week ended March 12 — excluding those in the Strategic…

U.S. Petroleum Stocks Rise as Weekly Demand Falls, EIA Says

Total domestic petroleum stockpiles increased in the final week of January while demand declined amid lighter needs for transportation fuels, the U.S. Energy Information Administration’s (EIA) Weekly Petroleum Status Report (WPSR) showed. Demand has proven choppy week/week over the last several months, but it has consistently been well below year-earlier, pre-coronavirus levels because of travel…

EIA Reports Increase in U.S. Crude Inventories, Decline in Exports

Commercial crude oil inventories in the United States increased by 4.4 million bbl during the week ending Jan. 15 amid an uptick in net imports, according to data published Friday by the Energy Information Administration (EIA). Crude inventories excluding the Strategic Petroleum Reserve increased to 486.6 million bbl for the period, about 9% above the…

U.S. Petroleum Inventories Drop as Producers Hold Line on Output, EIA Says

U.S. petroleum inventories declined during the week ended Jan. 8, the U.S. Energy Information Administration (EIA) said Wednesday, as overall demand increased and production held steady. EIA said in its Weekly Petroleum Status Report that total U.S. commercial petroleum inventories decreased by 9.4 million bbl in the week ended Jan. 8. Crude oil inventories —…

Oil Market Seen Swinging from Oversupply to Deficit in 2021 on Vaccine Rollout, Boosting WTI Price

The new year could see the global oil market swing from its current state of oversupply to some of the highest monthly supply deficits in years as the rollout of Covid-19 vaccines propels a recovery in demand, according to experts. Raymond James & Associates Inc. analysts said Monday they expect “hefty” crude oil inventory draws…

NGI The Weekly Gas Market Report

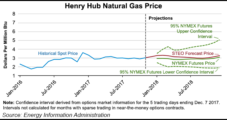

EIA Nudges 2018 Henry Hub NatGas Price Forecast Higher: $3.12/MMBtu

Growing natural gas exports and domestic gas consumption will help push Henry Hub prices to an average $3.13/MMBtu this month and $3.12/MMBtu in 2018, according to the Energy Information Administration (EIA).

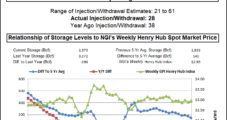

‘Bullish Surprise’ Following Lean NatGas Storage Build

August futures gained ground following a report by the Energy Information Administration (EIA) showing a natural gas storage injection that was less than what traders were expecting.