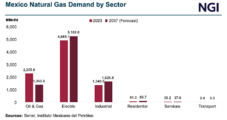

Mexico’s natural gas demand will be driven by its power and industrial sectors through 2037, according to a report from Mexico’s energy ministry Sener. The report, Prospectiva de Gas Natural 2023-2037, is a planning instrument to help with “the design of the integral national strategy around natural gas,” Sener said. It would be part of…

Tag / Industrial

SubscribeIndustrial

Articles from Industrial

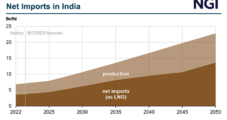

Equinor Nets 15-Year LNG Supply Agreement to Support Indian Ammonia Production

Norway’s Equinor ASA has agreed to supply one of India’s largest chemical manufacturers using its growing portfolio of Norwegian and U.S. LNG under a new long-term sales and purchase agreement (SPA). Deepak Fertilisers and Petrochemicals Corp. Ltd. has secured 0.65 million metric tons/year (mmty) of liquefied natural gas for 15 years from Equinor that it…

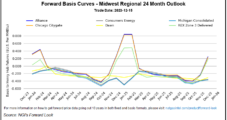

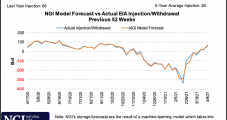

Resilient Economy, Potential for Interest Rate Cuts Could Power Industrial Natural Gas Demand, Support Prices

For all the talk about weak weather-driven demand in 2023, a buoyant U.S. economy may complement mounting global energy needs and provide a key pillar of strength for natural gas markets in the form of steady industrial demand in the new year. Over much of 2023, elevated inflation and the Federal Reserve’s (Fed) aggressive interest…

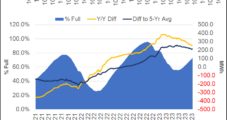

Analysts Warn Rising European Natural Gas Prices ‘Mask’ Overall Soft Demand – LNG Recap

Global natural gas prices are starting to tick upward once again as maintenance events and warmer weather appear to signal more demand for LNG, but analysts are warning a bearish summer could still lie ahead. After sliding for several weeks to the lowest points since 2021, prompt Asian and European prices began to rally again…

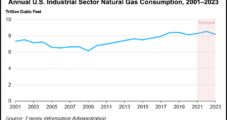

Industrial Natural Gas Demand to Peak in 2022 Before Tapering, EIA Says

Natural gas demand in the U.S. industrial sector will reach a record level in 2022, then ease next year amid high prices and slowing economic activity, federal researchers said Monday. The Energy Information Administration (EIA) forecasts industrial consumption will increase by 2.4% this year to 8.3 Tcf after rising 1.9% in 2021. The jumps follow…

‘Grass Is Greener’ in Mexico for Industrial Natural Gas Buyers, Says BP Exec

Mexico’s industrial natural gas consumers are adopting more sophisticated procurement strategies and seeking to lock in relatively cheap U.S. prices for as long as possible, according to BP plc’s Pedro Elio, head of origination for BP’s Mexico gas marketing business. Elio spoke Tuesday at LDC Forums’ US-Mexico Natural Gas Forum in San Antonio, TX. BP…

Sempra Nabs 1.4 MMTY Contract with UK’s Ineos for Proposed Gulf Coast LNG Projects

A subsidiary of Sempra has potentially netted another offtaker for two of its proposed Gulf Coast liquefied natural gas (LNG) projects as a European chemical manufacturer moves to secure natural gas supply. Sempra Infrastructure, the LNG and renewable infrastructure arm of the San-Diego based company, said it had a 1.4 million metric ton/year (mmty) heads…

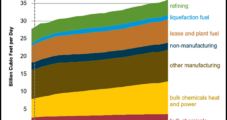

Energy Transition Advocates See Accelerated Path Away from Natural Gas for Heavy Industry

Some of the industrial sectors with the hardest carbon footprints to abate are also predicted to be key future consumers of natural gas, but energy transition experts see signs of change coming quicker than previously predicted. From 2020 to 2050, industrial use will make up more than 75% of natural gas demand growth, according to…

Navigator Sanctions Heartland System to Capture Midwest Industrial CO2 Emissions

Navigator CO2 Ventures LLC said Thursday it has binding commitments in hand to sanction the massive Heartland Greenway system, a 1,300-mile carbon capture pipeline that would traverse five states across the Midwest. As initially designed, Heartland would transport and sequester up to 15 million metric tons/year of carbon dioxide (CO2) from industrial customers in Illinois,…

Near-Record Export Demand Fuels More Gains for Natural Gas Futures, Cold Snap Boosts Cash

Natural gas futures resumed their climb on Monday, buoyed by near-record export demand and the arrival of chilly weather. With the latest forecast extending and intensifying the cooler temperatures, the May Nymex contract settled 6.9 cents higher at $2.749. June climbed 6.4 cents to $2.818. Spot gas prices also moved higher in most areas outside…