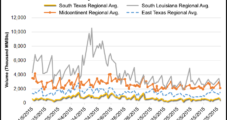

Mexico must develop a natural gas price index independent of U.S. benchmarks and develop a secondary market for pipeline capacity, according to experts who spoke last week in San Antonio, TX. Because of Mexico’s reliance on imports from the United States, natural gas in Mexico typically is priced using a U.S. index such as Henry…

Indexes

Articles from Indexes

FERC’s Proposed Natural Gas Price Index Changes Draw Mixed Reaction

Market participants are largely in favor of proposed federal modifications to the natural gas price indices policy to enhance price transparency and encourage transaction reporting to developers such as Natural Gas Intelligence (NGI). However, some respondents to FERC’s call for comments said the amendment to codify the “safe harbor” provision could go further (No. PL20-3-000).…

Ease Regulatory Burden on NatGas Price Reporters, Industry Tells FERC

FERC should do more to address the perceived regulatory risk of reporting to price indexes, panelists at a technical conference on natural gas index liquidity and transparency told Commission staff Thursday.

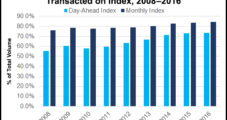

Plenty of Optimism Despite Declines in Reported Volumes, Says NGI Expert

The number of natural gas transactions disclosed to NGI and other price reporting agencies (PRA) has been in an overall decline since the financial crisis of 2008, but there are reasons to believe volumes are stabilizing and problems will be prevented before they reach a critical level, according to NGI’s Patrick Rau, director of Strategy & Research.

ICE to Provide NatGas Price Data to Platts

Intercontinental Exchange (ICE), which since 2008 has provided its daily and monthly physical natural gas prices for Natural Gas Intelligence (NGI) to incorporate into its published spot market price surveys, agreed Monday to provide similar data for S&P Global Platts. Under the agreement, ICE data would be anonymized and included as inputs into the Platts physical market price assessments in early 2017.

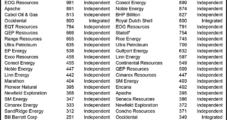

Kinder Morgan’s NGPL Joins Tennessee, Others in Switching to NGI Indexes

Kinder Morgan Inc. has requested FERC approval to switch the natural gas price indexes it uses to calculate various charges, such as cashouts on Natural Gas Pipeline Company of America (NGPL) [RP15-997] mainly to the indexes published by Natural Gas Intelligence (NGI).

Kinder Morgan’s NGPL Joins Tennessee, Others in Switching to NGI Indexes

Kinder Morgan Inc. has requested FERC approval to switch the natural gas price indexes it uses to calculate various charges, such as cashouts on Natural Gas Pipeline Company of America (NGPL) [RP15-997] mainly to the indexes published by Natural Gas Intelligence (NGI).

Concord Energy, Traders Fined $1.6M for 2000-02 Bogus Price Reporting

Concord Energy LLC and two traders were ordered by a Colorado court Tuesday to pay $1.6 million in penalties for falsely reporting natural gas information to published indexes in an attempt to manipulate natural gas prices, the Commodity Futures Trading Commission (CFTC) said.

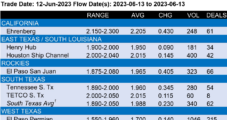

Coming Heat Relief Brings Softness to Most Points

Prices were mixed but mostly softer Wednesday as some relief from inferno-like heat indexes will be spreading Thursday through the Midwest and arriving later in the Northeast.

Most Cash Market Points Rise on Spreading Cold

The November aftermarket closed out Tuesday much as it spent virtually all of the month — with spot prices at dollar-plus deficits to first-of-month indexes at nearly all points (Questar and NIT [NOVA Inventory Transfer] were the exceptions). The spread of winter-like weather had most points on the rise, although flat to lower numbers were scattered here and there.