Woodside is further diversifying its LNG portfolio with more U.S.-sourced gas from a new supply agreement with Mexico Pacific Ltd. (MPL), tallying another major offtaker for the proposed Mexican terminal. Woodside has inked a 20-year, 1.3 million metric ton/year (mmty) sales and purchase agreement (SPA) for offtake from the Saguaro Energia LNG terminal on a…

Index

Articles from Index

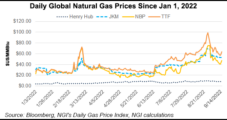

European Commission Exploring LNG Index as Alternative to TTF

Proposals by the European Commission (EC) to tame soaring energy costs don’t alter the role natural gas plays on the continent and may do little to rein in the volatility that has ruled the market this year. The EC proposed revenue caps on some power producers, a windfall tax on the excess profits of fossil…

Baltic Exchange Chief Sees No Need to ‘Reinvent the Wheel’ When it Comes to LNG Freight Markets

Baltic Exchange CEO Mark Jackson believes the nearly 300-year-old organization “sells trust” to the maritime industry, something that has factored heavily into its entry into the liquefied natural gas (LNG) market. Founded in 1744, the Baltic had its beginnings in the coffee houses of London where merchants and shipowners met. It provided rules for backroom…

Brazil’s Petrobras Giving Customers Option to Price Natural Gas Off Henry Hub

Petróleo Brasileiro SA (Petrobras) said on Monday it will allow prices indexed to Henry Hub to be used in the sale of natural gas to distributors. The move is part of an ongoing gas market reform spurred by new legislation opening the midstream and downstream segments to new players. Inspired by the “prospect of a…

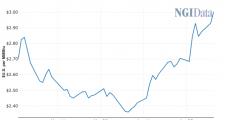

PRAs Tout Confidence in Long-Term Liquidity of Natural Gas Published Indexes

Two leading Price Reporting Agencies (PRA) indicated that the decline in reported transactions has leveled off in recent years, and they remain confident that the data received from the market is sufficient to determine published natural gas indexes. Representatives from Natural Gas Intelligence and S&P Global Platts each cited recent stabilization in reporting numbers and…

Texas Oil, Gas Industry Losing Jobs, Rigs but Production Still Gushing to Record Levels

Oil and natural gas activity in the Lone Star State remained flat through the first quarter, both year/year and sequentially, even as oil prices improve and production is at record levels and climbing, according to the Texas Petro Index (TPI).

No Relief Likely in Permian Takeaway Before Late 2019, Energy Execs Tell Dallas Fed

Oil and natural gas sector activity continued its momentum during the third quarter across Texas, northern Louisiana and southern New Mexico, according to a survey of energy executives, but many are concerned that it’s going to take awhile before any relief in pipeline constraints in the Permian Basin.

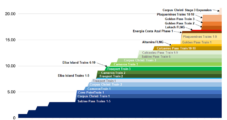

Six-Region Natural Gas Prices Going Live Later this Month, Mexico’s CRE Says

The Mexican energy regulator plans to publish prices for six natural gas trading regions, with the first report due later this month.

August Reported Volumes More than Double in Mexico’s Latest NatGas Price Index

Natural gas trading volumes reported to the Mexican energy regulator in August more than doubled over the previous month.

Mexico’s CRE Publishes First Monthly Natural Gas Price Index

Marketers in Mexico sold natural gas at an average of price $4.10/MMBtu in July, the first month since the country implemented its capacity reservation regime.