American Noble Gas Inc. is ready to sell output from an exploratory well near Garden City at the Hugoton natural gas field in Haskell and Finney Counties, KS. The initial well was connected to the gathering system on August 11, which marked the beginning of the flow of natural gas and helium for commercial sales,…

Hugoton

Articles from Hugoton

Riviera to Sell Stakes in Hugoton Basin for $31M

Riviera Resources Inc. has agreed to sell its interest in properties in the Hugoton Basin of southwestern Kansas, its largest producing asset, to an undisclosed buyer for $31 million.

Swap Gives ExxonMobil More Permian Prospects, Crowns Linn as Biggest Hugoton Operator

ExxonMobil Corp. will build its Permian Basin position to 1.5 million acres and Linn Energy LLC is becoming the biggest producer in the Hugoton Basin of Kansas after the producers agreed to a trade, sans cash, late Wednesday.

Oxy Looking to Sell ‘Selective’ Midcontinent Assets

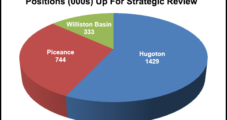

As part of a strategic review aimed at forming a smaller, more profitable company, Los Angeles-based Occidental Petroleum Corp.’s (Oxy) board of directors on Friday authorized pursuit of selected asset sales, including potentially some overseas and Midcontinent assets, alongwith a portion of a general partner interest in Plains All American Pipeline (PAAP).

Industry Briefs

Linn Energy LLC has agreed to pay $1.2 billion to acquire BP plc’s Hugoton Basin properties in Kansas, the largest conventional gas field in the United States. The agreement, set to close by the end of March, includes the 450 MMcf/d Jayhawk Natural Gas Processing Plant and 2,400 producing gas wells on 600,000 net acres. The properties have a decline rate of about 7% and are expected to provide 110 MMcfe of liquids production, Linn CEO Mark E. Ellis said. The wells are 98% operated, with an estimated 800 future drilling locations. The leasehold is 63% weighted to gas, and reserves life is estimated at 18 years. Proved reserves are estimated at 730 Bcfe, with 81% proved developed. Linn entered into hedging contracts for 100% of the natural gas production associated with the transaction through 2016 using a combination of 50% swaps and 50% puts. In addition, 68% of the natural gas liquids output is hedged through 2016.

Linn to Pay BP $1.2B for Hugoton Basin Leasehold

Linn Energy LLC late Monday said it agreed to pay $1.2 billion to acquire BP plc’s natural gas rich Hugoton Basin properties in Kansas.

Transportation Notes

The Hugoton (KS) Plant shut down for Thursday only to makeunplanned pipeline repairs. Northern Natural Gas said 35,000MMBtu/d at 13 receipt points was affected.