As an outgrowth of state safety laws passed after the San Bruno natural gas pipeline explosion, Sempra Energy’s Southern California Gas Co. (SoCalGas) has completed the first conversion of a mobile home park gas system to utility ownership and operation.

Home

Articles from Home

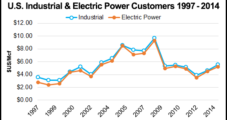

AGA Sees More Burner Tip Cheer This Winter

Robust production, high storage levels and increasing efficiencies will make for residential natural gas bills that are 5-7% lower this winter than last, the American Gas Association (AGA) said. The cheapest home heating option is now even cheaper, according to the organization representing natural gas utilities.

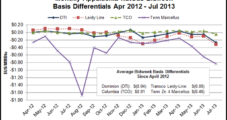

Appalachian Production Crying Out for Interstate Connections

Production in the Marcellus Shale over the past few years “has been nothing short of epic,” and it is straining infrastructure to the point that the Appalachian region is in need of larger interstate connections, said Genscape Inc. senior natural gas analyst Andy Krebs.

No Injuries Reported in FGT Louisiana Explosion

An explosion early Tuesday morning on the Florida Gas Transmission (FGT) pipeline in Washington Parish, LA, 80 miles north of New Orleans destroyed a mobile home and caused the evacuation of 55 area residents. Gas supplies moving on the west-to-east pipeline were rerouted, operator Energy Transfer Partners said. No injuries were reported

TECO Gains Entry into New Mexico with $950M Deal

Florida-based TECO Energy last week struck its first utility purchase outside its home state in an agreement to buy New Mexico Gas Co., the state’s principle gas provider, for $950 million, including $200 million of debt. The transaction adds 50% to TECO’s Sunbelt-focused customer base.

People

John H. Williams, 94, a founding leader of natural gas midstream and pipeline giant Williams, died Wednesday at his home in Linville, NC. He had worked for Williams Brothers founders Dave and Miller beginning in 1938, and 11 years later he, his brother Charlie and cousin David bought the company. John Williams served as president and CEO until 1971 and as chairman and CEO from 1971 to 1979. One of his signature achievements was the 1966 purchase of Great Lakes Pipe Line, which at the time was substantially larger than his company. In his tenure as CEO, Williams’ market value increased from $25,000 in 1949 to $406.5 million in 1978. From 1964 to 1974, the average combined return to investors ranked No. 1 among Fortune 500 companies. John Williams is survived by his wife, Joanne, and three sons. “This is a huge loss to many of us personally and certainly for our great company,” said Williams CEO Alan Armstrong. “He has been an inspiration to all who have been lucky enough to know him.”

Dow-Backed Study Says Keep Gas at Home

Keeping U.S. natural gas at home would yield more economic bang per molecule than liquefying and exporting it, according to a study conducted by Charles River Associates and paid for by The Dow Chemical Co., which has lobbied hard against exporting liquefied natural gas (LNG).

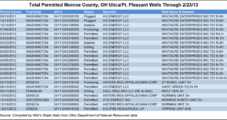

Ohio Judge Upholds Class Action Suit, Denies XTO Motion to Intervene

An Ohio judge has upheld a class action lawsuit against a Utica Shale driller, a decision that could release hundreds of landowners from undeveloped oil and natural gas lease agreements.

Industry Brief

Home heating products retailer Dead River Co. plans to sell and supply compressed natural gas (CNG) to commercial and institutional customers in central, northern and eastern Maine from Xpress Natural Gas’ (XNG) soon-to-be-completed CNG terminal in Washington County, ME, the companies said. The customers to be served typically use at least 75,000 gallons of heating oil annually. Boston-based XNG currently trucks liquefied natural gas to industrial customers. The partnership brings together XNG proprietary technology with Dead River’s more than one hundred years of experience in trucked fuels and energy services.

LNG Exports Seen Making Bigger Ripples Abroad

The impact of U.S. exports of liquefied natural gas (LNG) on global gas markets would be more significant than what would be felt at home, a new analysis by Deloitte found. World gas prices would decline further than domestic prices would rise, and U.S. exports could hasten a migration away from oil-indexed gas contracts, the firm said.