Aside from further discounts at Western Lower 48 hubs, natural gas forwards generally gained ground during the Dec. 14-20 trading period as the prospect of chillier conditions arriving in early 2024 lent support to prices. Fixed prices for January and February delivery rallied week/week at Henry Hub. The January contract at the national benchmark exited…

Tag / Historical

SubscribeHistorical

Articles from Historical

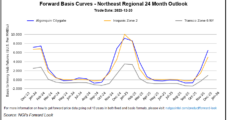

Northeast Basis Soars, But Futures Ignore Forecasted Heat

Physical natural gas prices overall added 4 cents Tuesday as bidweek trading got into full swing. Traders saw most resorting to historical purchases and sales of bidweek volumes with no one trying to buy or sell index based on expected market direction. Eastern and Northeast points led the day’s advance, but most market points were steady to slightly higher, and only a few reported losses. At the close of futures trading, June had skidded 6.3 cents to $4.174 and July was off 6.0 cents to $4.224. July crude oil added 86 cents to $95.01/bbl.

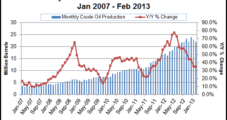

North Dakota Sets More Records in February

Although overall month-over-month totals were down, production rates set all-time high marks for oil and natural gas in February in North Dakota, state officials reported Tuesday.

Unconventional Opportunities Still Open in North America, Says Tudor

North American oil and natural gas producers are in the “middle to latter stages of the land grab” for unconventional properties, but there still will be opportunities down the road for others to pitch a claim, said Tudor, Pickering, Holt & Co. Inc.’s (TPH) Bobby Tudor.

State Severance Taxes, Fracking Rules Rated

The four top natural gas producing states in the Lower 48 states — Texas, Oklahoma, Louisiana and Wyoming — are collecting severance taxes on their dry gas of between 14.7 and 18.5 cents/Mcf based on recent gas prices, according to a review of regulations and taxes by Washington, DC-based Resources for the Future’s Center for Energy Economics and Policy (CEEP).

North America ‘Import Dependence’ Nearly Over by 2030, Says BP

Supported by abundant unconventional natural gas and oil reserves, the United States and Canada will become “almost totally energy self-sufficient” by 2030, according to a new forecast by BP plc.

Brief 50-Cent Dump Possible, Analyst Says; October Expires Weakly

October futures limped to a weak expiration Wednesday on the eve of a government report expected to show a storage increase well above historical norms. At the close October had retreated 6.8 cents to $3.759 and November had given up 7.6 cents to $3.799. November crude oil tumbled $3.24 to $81.21/bbl.

More Fund Selling Still In the Mix; October Weakens

October natural gas retreated Tuesday as not all traders are on board with historical seasonal weakness leading to higher prices and the funds and managed accounts being unwilling to push the market lower from present price levels. October lost 3.1 cents to $3.798 and November shed 4.7 cents to $3.885. October crude oil rose $1.19 to $86.89/bbl.

Additional PG&E Pipe Safety Data Sent to CPUC

Pacific Gas and Electric Co. (PG&E) has submitted more historical data to California regulators on the safety and maintenance of its natural gas transmission pipeline system. This supplements information provided in the wake of last September’s pipeline rupture and explosion in San Bruno, CA.

Additional PG&E Pipeline Safety Data Submitted to CPUC

Pacific Gas and Electric Co. (PG&E) last Friday submitted more historical data to California regulators on the safety and maintenance of its natural gas transmission pipeline system. This supplements earlier information provided in the wake of last September’s pipeline rupture and explosion in San Bruno, CA.