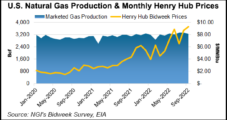

Natural gas hedging by North American producers was subdued during the third quarter while oil activity rose, despite the near-term bullish outlook for oil and the bearish forecast for gas, according to Enverus. Each quarter the energy data consultancy reviews North American exploration and production (E&P) hedging activity to check incremental activity, valuations and implications…

Hedging

Articles from Hedging

U.S. E&Ps Hedging Less, Moving Cautiously with Bank Redeterminations Underway

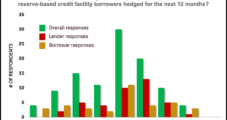

The U.S. oil and natural gas industry is hedging less to avoid leaving money on the table, but overall, operators appear less optimistic regarding their ability to borrow funds, according to a new survey. “Strong oil and gas prices are not directly resulting in strong borrowing base increases,” Haynes and Boone LLP researchers said in…

Lower 48 Natural Gas-Focused E&Ps Potentially Eyeing ‘22 Hedging Losses on Early Price Bet

U.S. natural gas producers hedged most of their 2022 output before prices began to soar, setting the sector up for a slew of one-time losses on the wrong-way bets, according to Rystad Energy. When exploration and production (E&P) companies hedge their gas production, they typically take an opposite position in the forecast price. However, increasing…

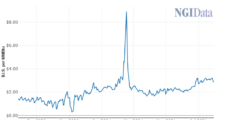

Cabot, Southwestern See Natural Gas Prices Impacted by Appalachian Pipeline Constraints

Cabot Oil & Gas Corp. and Southwestern Energy Co. were the latest Appalachian operators to report weak price realizations in the second quarter, when pipeline constraints widened basis differentials in the Northeast. U.S. benchmark prices climbed during the period and have continued to move higher since, creating an even bigger gap with local prices in…

U.S. E&Ps Seen Cutting Exposure to 2021 Natural Gas Prices, but Boost Oil Hedging

U.S. producers have decreased their exposure to natural gas prices and boosted it for oil heading into 2021, which could have a significant impact on the bottom line, according to Raymond James & Associates Inc. Analyst John Freeman said in a note Monday the exploration and production (E&P) companies covered by Raymond James had hedged…

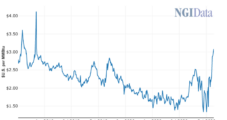

Lower 48 E&Ps Seen Protecting ‘21 Natural Gas Below ‘20 Price, with Oil Hedged Higher

More than 45% of expected natural gas production in 2021 is hedged at a Henry Hub base price of $2.58/MMBtu, marginally lower than the 2020 price of $2.70, according to a Rystad Energy analysis of U.S. producers. The analysis also determined exploration and production (E&P) companies have to date hedged 41% of forecast 2021 oil…

Most Lower 48 E&Ps Still Exposed to 2020 Oil, Natural Gas Prices

U.S. explorers still have a lot of exposure to oil and natural gas prices in 2020 as the fourth quarter nears, but if oil prices move higher as many experts are forecasting, that strategy may prove to be a winner.

U.S. E&Ps Hedging Modestly for 2018, 2019; Permian Exposure on Radar

U.S. exploration and production (E&P) companies slightly increased their 2018 oil hedging during the second quarter, with 2019 still around normal levels, even though oil futures inched above long-term budgets of $50-55/bbl, according to a review by Goldman Sachs.

Washington State Regulators Want NatGas Utilities to Update Hedging

Regulators in the state of Washington on Monday launched a process for revising the approach of the state’s natural gas utilities toward hedging their future gas supply purchases.

North American E&Ps Facing Year With Few Hedges

U.S. and Canadian producers have hedged only 15% of total oil and natural gas volumes for 2016 and 5% of their volumes for 2017, which may leave them even more exposed to depressed prices.