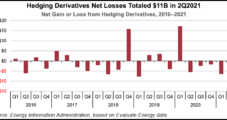

Global oil and natural gas explorers made some wrong-way bets on the direction of commodity prices during 2Q2021, with hedging losses for 90 of the biggest U.S. and overseas producers totaling $11 billion, the Energy Information Administration (EIA) said Wednesday. The net hedging losses among the world’s largest exploration and production (E&P) companies were the…

Hedges

Articles from Hedges

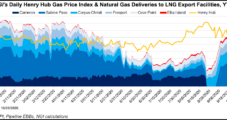

Hedgeable LNG Market at Least Five Years Away, Tellurian’s Souki Says

It will take at least five more years for the global liquefied natural gas (LNG) market to become a fully hedgeable market like oil, said Tellurian Inc. chairman and LNG pioneer Charif Souki in an interview posted Thursday by IHS Markit. The LNG market, which originated decades ago as a point-to-point business with long-term contracts…

U.S. Oil Producers Escalate Hedges in Wake of Coronavirus Confusion, Price Collapse

Energy companies ramped up hedging activity as the demand and price shocks of the coronavirus pandemic roiled the oil and gas sector during the second quarter. A new U.S. Energy Information Administration’s (EIA) analysis of 2Q2020 financial disclosures from 77 publicly traded domestic crude oil producers found that the companies collectively entered into hedging contracts…

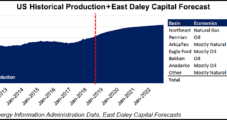

Another 22 Bcf/d Lower 48 Supply Growth Forecast by 2023

Going back to last year, natural gas production forecasts based on drilling fundamentals missed key signals from equity markets that had predicted the recent surge in Lower 48 supply, according to East Daley Capital’s Matthew Lewis, who directs financial analysis for the firm.

Permian E&Ps Significantly Boost 2020 Oil Hedges — Possibly on Doubts about Pipeline Completions

Oil and gas producers working in the Permian Basin increased their 2020 oil basis hedge positions by 431% during the second quarter, a sharp uptick that may signal doubts about 2019 target dates for key pipeline projects, Wood Mackenzie analysts said Tuesday.

Cimarex Secures 98% of Permian Gas Takeaway to October 2019

Cimarex Energy Co. has agreed to sell more than 98% of its projected natural gas production in the Permian Basin through October 2019, on concerns that operators will continue to be impacted by increased local price differentials until additional pipeline capacity is brought online.

Antero Nets $1B-Plus in Stock Offering, NatGas Hedge Restructuring

Antero Resources Corp. said Thursday that it earned more than $1 billion through a stock offering and changes to its natural gas hedge portfolio, securing some of the cash it needs to support year/year production growth of 20-22% through 2020.

Permian E&Ps Protecting Rapid Production Buildup by Hedging, Says IHS Markit

Oil-weighted exploration and production (E&P) companies operating in the prolific Permian Basin have 65% of their output hedged at an average strike price of $50/bbl, which supports aggressive drilling targets this year, according to IHS Markit.

Models Show Slightly Cooler Temps; January Called Unchanged

January natural gas was set to open flat Wednesday morning at $3.31 as traders studied weather models, and the energy complex gets a boost from surging oil quotes. Overnight oil markets soared on hints of an OPEC deal to curb production.

U.S. E&P Capex Down 60% from 2014, Operators Also Less Hedged

Spending by U.S. producers is estimated to be down around 60% from 2014 — twice as much as some analysts have estimated, Raymond James & Associates Inc. said Monday. North American producers also have less protection from sustained low commodity prices than they did a year ago because of less hedging, according to Barclays Capital.