An upturn in oil pricing since the start of the year has led many U.S. exploration operators to go “hog wild” in the futures market by increasing 2017 hedged oil and natural gas volumes sharply above levels at the start of this year, Raymond James & Associates said this week.

Hedge

Articles from Hedge

NGSA Urges Changes to CFTC’s Supplemental Position Limits Rule

The Natural Gas Supply Association (NGSA) has recommended that the Commodity Futures Trading Commission (CFTC) tweak a proposed supplement to its position limits rule, after identifying three specific areas of concern.

Williams ‘Aligned’ with Activists’ Push for Value, Says CEO

Williams management is “very well aligned” with two hedge funds holding nearly 10% of the stock and continues to have discussions on plans to create value, CEO Alan Armstrong said Thursday.

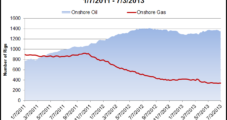

U.S. E&P Capital Plentiful, but Onshore Oil Still Top Target

The capital markets for U.S. exploration and production (E&P) companies “appear wide open,” with most of the available funds likely to target onshore oil instead of natural gas through 2014, Barclays Capital analysts said on Wednesday.

Court: FERC Lacks Jurisdiction in Futures Markets

A federal appeals court in Washington, DC, Friday granted the plea of a former natural gas trader for failed hedge fund Amaranth Advisors LLC to overturn an agency order imposing a $30 million penalty for allegedly manipulating natural gas futures.

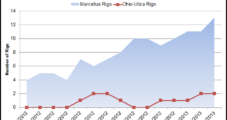

Refocused on Appalachia, Antero Grew Production Last Year

While it let go of acreage in the Arkoma and Piceance basins last year, production from Antero Resources’ booming Marcellus Shale activities more than made up for their absence in the company’s portfolio of producing assets.

Global E&P Execs Optimistic But Wary

Global oil and natural gas executives are optimistic about the year ahead, but instead of expanding their operations, many are using the boom times to hedge against the short-term uncertainties, according to a new survey by BDO.

Court: FERC Lacks Jurisdiction in Futures Markets

A federal appeals court in Washington, DC, Friday granted the plea of a former natural gas trader for failed hedge fund Amaranth Advisors LLC to overturn an FERC order imposing a $30 million penalty for allegedly manipulating natural gas futures.

Global E&P Execs Optimistic But Wary, Says BDO Survey

Global oil and natural gas executives are optimistic about the year ahead, but instead of expanding their operations, many are using the boom times to hedge against the short-term uncertainties, according to a new survey by BDO.

‘Attractive Prices’ Lead Atlas to Add to Barnett Leasehold

Atlas Resource Partners LP (ARP) has picked up its third big leasehold this year in the Barnett Shale by agreeing to pay $255 million to DTE Energy Co. for an affiliate that owns close to 35 million boe of proved reserves in the Fort Worth Basin and in the Marble Falls, TX, area.