There is still a lot of gas hanging out in the Haynesville Shale; it’s just waiting for the right commodity price and drilling technology to set it free, according to researchers at the Bureau of Economic Geology (BEG) at the University of Texas at Austin.

Tag / Haynesville

SubscribeHaynesville

Articles from Haynesville

Exco Looking Only to Haynesville Natural Gas Development Through First Half of 2016

Dallas-based onshore operator Exco Resources Inc., pressured for months by low oil prices, said Wednesday it will focus nearly all of its activity in the first half of 2016 on its natural gas portfolio in the Haynesville Shale.

Encana Sells Haynesville Leasehold to GeoSouthern JV For $850M

Encana Corp. is selling its once-heralded Haynesville Shale natural gas portfolio, where it today has about 300 wells across 112,000 net acres, for $850 million to strengthen its ailing balance sheet.

Both Haynesville, Appalachia Seen as Marginal Sources of U.S. NatGas Production

The Haynesville Shale may be competing with Marcellus/Utica shale gas in the not-too-distant future, lifted by its solid reserves, infrastructure and its proximity to liquefied natural gas (LNG) export facilities, according to research by NGI’s Shale Daily.

Chesapeake Seen Benefiting From Renewed Haynesville Exploration, Exports

Chesapeake Energy Corp.'s decision to increase its natural gas drilling in the Haynesville Shale this year may have startled some investors, but the gaggle of government approvals for proposed natural gas export facilities on the Gulf Coast may be playing right into the Oklahoma City operator's wheelhouse.

Industry Briefs

Calfrac Well Services Ltd.has agreed to acquire all of the operating assets ofMission Well Services LLC, a privately-held hydraulic fracturing and coiled tubing services provider focused on the Eagle Ford Shale, for $147 million. Calfrac will acquire 157,500 hp of conventional pumping equipment, along with high-rate blenders, related sand-handling and auxiliary equipment, three deep-capacity coiled tubing units with related fluid and nitrogen pumping units and a modern district facility in San Antonio. Calfrac will gain a foothold in the Texas market with the addition of locations in Houston, San Antonio and Fairfield. The company is assuming certain commitments with key suppliers of Mission and will be offering employment to a significant portion of Mission’s employees. Calfrac intends to transfer a portion of the assets to other active operating areas in the United States. With the acquired assets, Calfrac will have more than 1.18 million hp of conventional pumping capacity.

Analysts Recommend Measured Approach to LNG Exports

U.S. policymakers should consider approving 1.5-2 Bcf/d of liquefied natural gas (LNG) export capacity each year, which would avoid rocking the domestic gas market and be a pace that shale gas producers could keep in step with, analysts at Bernstein Research said in a note.

Permian Oil Propels Devon to Record Average Daily Production

Strong growth in oil production — especially in the Permian Basin — propelled Devon Energy Corp. to record the highest average daily production rate in its history during the second quarter of 2013, as the company also saw positive test results in the Woodford Shale.

EXCO Pins Hopes to JVs, Eagle Ford and Haynesville Expansions

Officials with EXCO Resources Inc. said its acquisitions in the Eagle Ford and Haynesville shales during the second quarter were the foundation for future expansion, while its financial position would be bolstered through its joint ventures (JV) with Kohlberg Kravis Roberts & Co. LP (KKR), Harbinger Group Inc. and BG Group plc.

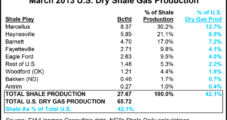

Most U.S. NatGas Plays Make Money at $4.00-Plus, Says Raymond James

Nearly every major natural gas play in the United States makes money at prices above $4.00/Mcf, and more important, can generate a “decent rate of return” at prices above $4.25, according to an analysis by Raymond James & Associates Inc.