Privately held Harvest Midstream Co. has brought online two connections in South Texas to deliver crude from its Ingleside Pipeline to Moda Midstream LLC facilities. The first connection provides shippers access from the Ingleside system to Moda’s Ingleside Energy Center, which also has connectivity to the Gray Oak and Epic Crude Oil pipelines, which move…

Harvest

Articles from Harvest

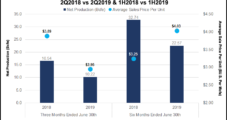

Gas-Focused Harvest Oil Posts Loss, Output Declines

Houston-based Harvest Oil and Gas Corp., which has a natural gas-weighted asset base in formations across the Lower 48, posted significant year/year declines in production for the second quarter.

EV Energy Emerges from Bankruptcy as Harvest Oil

Houston-based EV Energy Partners LP on Monday said it successfully navigated its financial restructuring and has emerged from Chapter 11 as Harvest Oil & Gas Corp.

More NGL Takeaway Planned in Ohio

A 12-inch diameter, 38-mile natural gas liquids (NGL) pipeline to be built in a portion of Ohio’s Utica Shale would be capable of delivering 90,000 b/d, Pennant Midstream LLC said Monday.

Alberta Government Not Ready to Grant New CBM Incentives

Developers of new Alberta natural gas supplies, led by the budding coalbed methane harvest, have received official notice that this is the wrong time to ask for government incentives in Canada’s chief producing province. Erosion of the Alberta government share of revenues generated by increased gas and oil prices has ignited questions even among the province’s ruling Conservatives and a government review of the royalty structure is under way.

Industry Briefs

EnCana Corp. has completed its sale of some heavy-oil assets in east central and southern Alberta to Harvest Energy Trust for US$395 million. The property sale represents about 16,800 boe/d of production after royalties and is made up of predominantly medium- and heavy-oil assets. The sale is part of EnCana’s first tranche of divestitures to reduce its debt. Tristone Capital Inc. served as a financial adviser to EnCana on this transaction.