The overall market Tuesday was flat, but modest strength at Northeast and eastern points offset the more than a handful of Rockies locations which traded anywhere from a couple of pennies to close to a dime lower. A Connecticut nuclear outage was expected to ripple through the markets Wednesday. At the close of futures trading September had risen 10.5 cents to $2.834 and October was up 10.3 cents to $2.871. September crude oil gained 70 cents to $93.43/bbl.

Handful

Articles from Handful

Bidweek: Marcellus Shale Price Falls; Other Points Gain

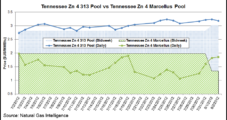

August natural gas bidweek prices saw stout gains across the board except for a handful of Marcellus Shale trading points as NGI’s National Spot Gas Average came in 28 cents higher than the previous month at $3.00/MMBtu, according to Natural Gas Intelligence (NGI), which has unveiled a number of new market pricing locations with its latest monthly price survey.

Marcellus Shale Price Drops Stand Out Among August Bidweek Gains

August natural gas bidweek prices saw stout gains across the board except for a handful of Marcellus Shale trading points as NGI’s National Spot Gas Average came in 28 cents higher than the previous month at $3.00/MMBtu, according to Natural Gas Intelligence (NGI), which has unveiled a number of new market pricing locations with its latest monthly price survey.

Marcellus Shale Price Drops Stand Out Among August Bidweek Gains

August natural gas bidweek prices saw stout gains across the board except for a handful of Marcellus Shale trading points as NGI’s National Spot Gas Average came in 28 cents higher than the previous month at $3.00/MMBtu, according to Natural Gas Intelligence (NGI), which has unveiled a number of new market pricing locations with its latest monthly price survey.

Northeast Points Rocket Higher; Other Locations Post Gains As Well

Overall cash prices advanced on average by six cents Monday with the greatest gains reserved for a handful of Northeast points as forecasted hot weather combined with delivery restrictions. Texas and California points recorded nominal gains. At the close of futures trading August had fallen 7.3 cents to $2.801 and September had shed 7.6 cents to $2.793. August crude oil added $1.33 to $88.43/bbl.

Mild Cash Strength Overshadowed by Futures Free-Fall

The cash market overall Tuesday was on average a penny higher with mild strength evident in most regions. More than a handful of Northeast points weakened. Futures found the rarefied air of Monday’s gains unsustainable and recorded a double-digit loss. At the close August had dropped 14.6 cents to $2.737 and September had lost 14.8 cents to $2.728. August crude oil dropped $2.08 to $83.91/bbl.

Most Cash Points, Futures Take Seasonal Slide

Most cash market averages inched lower Tuesday with the exception of a handful of Northeast points, much of the Midcontinent and California locations, which posted gains.

Fracking Proposals Advance in North Carolina

A series of legislative proposals that would allow hydraulic fracturing (fracking) and enact several other changes to North Carolina’s energy policies within two years have cleared an important hurdle and could come to a vote this summer.

SRBC Approves Water Withdrawal Permits, Some for Second Time

Despite a handful of protesters, the Susquehanna River Basin Commission (SRBC) on Thursday voted to approve 42 water withdrawal permit applications, including most that it had approved at a disrupted meeting in December.

Oversold Rally Suggested, Yet Storage Data Encourages Bears

Next-day gas prices continued to erode Thursday except for in the Northeast, where a handful of points picked up between 10 to 20 cents. Weakness was widespread but was most pronounced at Wyoming points and locations eastward into the Midcontinent. Increases in the Northeast were only partially able to offset the general decline. Futures bears were pleased with the 10:30 a.m. EST storage report, which showed a withdrawal somewhat less than expectations.