A follow-up documentary on natural gas drilling by propagandist Josh Fox premiered on HBO last week, offering some half-truths and outright distortions about the oil and gas industry, as well as President Obama’s energy policies.

Half

Articles from Half

Gasland II Seen as Anti-Drilling Propaganda

A follow-up documentary on natural gas drilling by propagandist Josh Fox premiered on HBO Monday night, offering some half-truths and outright distortions about the oil and gas industry and on President Obama’s energy policies.

People

Commodity Futures Trading Commissioner Jill Sommers, one of two Republicans at the agency, said she will leave on Monday (July 8), one and a half years before her term is due to end in October 2014. Her resignation does not come as a surprise as she informed President Obama in January that she planned to leave (see NGI, Jan. 28). Asked where she intended to go after the CFTC, Sommers told NGI, “I don’t know. I have not started looking for my next opportunity yet.” Before leaving the agency, she pledged to carry out the investigation into MF Global Holdings Ltd. and former CEO Jon Corzine, a former U.S. senator and New Jersey governor; and an assistant treasurer for illegal use of customer money. The CFTC recently filed a proposed order against MF Global and Corzine, which is the subject of review by the U.S. District Court for the Southern District of New York. Because CFTC Chairman Gary Gensler had ties to MF Global and Corzine, Sommers was picked to lead the investigation into the company’s collapse, which took with it an estimated $1.2 billion in customer funds (see NGI, Nov. 14, 2011). Sommers has been on the Commission as it worked on Dodd-Frank Wall Street Reform Act. She was first sworn in as Commissioner in August 2007 for a term that expired in April 2009 then renominated by Obama to serve a second term. Some CFTC observers consider Christopher Giancarlo, executive vice president of the brokerage firm GFI Group Inc., a likely candidate to replace Sommers. “It’s not a fact, so we’re not going to comment,” said a GFI spokeswoman of the rumors, which she said had been circulating for a few weeks. Giancarlo is no stranger to Capitol Hill. He has testified several times about the challenges of implementing Dodd-Frank.

NGI The Weekly Gas Market Report

People

Commodity Futures Trading Commissioner Jill Sommers, one of two Republicans at the agency, said she will leave on Monday (July 8), one and a half years before her term is due to end in October 2014. Her resignation does not come as a surprise as she informed President Obama in January that she planned to leave (see NGI, Jan. 28). Asked where she intended to go after the CFTC, Sommers told NGI, “I don’t know. I have not started looking for my next opportunity yet.” Before leaving the agency, she pledged to carry out the investigation into MF Global Holdings Ltd. and former CEO Jon Corzine, a former U.S. senator and New Jersey governor; and an assistant treasurer for illegal use of customer money. The CFTC recently filed a proposed order against MF Global and Corzine, which is the subject of review by the U.S. District Court for the Southern District of New York. Because CFTC Chairman Gary Gensler had ties to MF Global and Corzine, Sommers was picked to lead the investigation into the company’s collapse, which took with it an estimated $1.2 billion in customer funds (see NGI, Nov. 14, 2011). Sommers has been on the Commission as it worked on Dodd-Frank Wall Street Reform Act. She was first sworn in as Commissioner in August 2007 for a term that expired in April 2009 then renominated by Obama to serve a second term. Some CFTC observers consider Christopher Giancarlo, executive vice president of the brokerage firm GFI Group Inc., a likely candidate to replace Sommers. “It’s not a fact, so we’re not going to comment,” said a GFI spokeswoman of the rumors, which she said had been circulating for a few weeks. Giancarlo is no stranger to Capitol Hill. He has testified several times about the challenges of implementing Dodd-Frank.

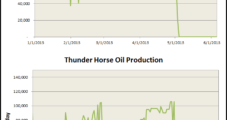

Onshore Crude May Temper Alaska, GOM Shut-Ins

Maintenance work on two platforms in the Gulf of Mexico (GOM) and on a project shutting in some crude oil in Alaska may halt temporarily the growth in U.S. crude oil supplies, but onshore volumes should help alleviate the shortfall, according to energy analytics provider Genscape Inc.

Church Group Lifts Leasing Ban, in Talks Over Shell Pipeline

Members of the Pittsburgh Presbytery voted to end a one-year moratorium on shale development, a decision that could potentially open property from the organization’s 150 churches to Marcellus Shale oil and gas leasing.

Great Lakes Posts Gains, But Overall Market Flat; Futures Waft Lower

Natural gas cash prices overall added just a half-cent Wednesday as temperatures were forecast to take a dive over the next several days. Midwest and Great Lakes points were higher by a couple of pennies, but Northeast and eastern locations eased. At the close of trading, June futures had fallen 0.6 cent to $4.186 and July was off 0.6 cent as well to $4.233. July crude oil tumbled $1.90 to $94.28/bbl.

Shales Are a Means, Not an End, Says CERA Co-Founder

The shale gas and oil revolution has created a 20-year opportunity for technology and sustainable economic development, but to realize its full potential, the people who think about energy will have to adopt a new mindset, Deloitte’s Joseph Stanislaw said in a new whitepaper, in which he argues that shale resources should be a bridge to a lower-carbon future.

OR Backers: Two Oregon LNG Projects On Track; BC Problematic

While there continues to be uncertainty among more than a half-dozen proposed West Coast projects in British Columbia, the backers of two long-standing liquefied natural gas (LNG) export-import projects in Oregon told NGI Wednesday they are alive and well and several steps ahead of their competitors in western Canada.

Northeast Eases, But Midcontinent, East Firm; Futures Inch Higher

Physical natural gas fell all of a half cent on average Thursday as traders got most deals done prior to the Energy Information Administration (EIA) report on natural gas inventories.