Qatar Petroleum (QP) has secured roughly 40% of the capacity available at Europe’s largest liquefied natural gas (LNG) import terminal in the UK, solidifying the state-owned company’s role as the region’s dominant supplier. QP said an affiliate signed a 25-year agreement for 7.2 million tons (Mt) of storage and regasification capacity annually at National Grid…

Grain

Articles from Grain

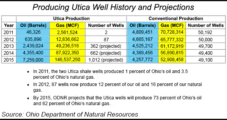

Ohio’s Utica Oil Figures Disappoint, But Sweet Spots Emerging

Industry experts said they were disappointed by the Utica Shale oil production figures for 2012 released Thursday by the Ohio Department of Natural Resources (ODNR), but they believe a clearer picture is beginning to emerge of where the play’s sweet spots for oil are located.

New England Prices Up Again; Most Points Soft

Continued large gains at New England citygates went against the overall grain of flat to lower prices in nearly all of the rest of the market Thursday. An early taste of winter-like conditions was still hanging around from the Rockies through the Midwest and Northeast, but the cold was due to start fading going into the weekend even as a cold front was about to bring cool temperatures into the previously moderate South.

Most of Market Falls; Northeast Sees New Spikes

Soaring citygate numbers in the Northeast, where a major Nor’easter was forecast to develop during the weekend, ran against the grain of falling prices everywhere else Friday. Weather moderation was expected to begin in some areas early this week, and a prior-day 21.5-cent decline by January futures along with the decline of industrial load that occurs during a weekend contributed further negative guidance for Friday’s cash market.

Moderate Show of Price Strength Not Expected to Last

Flat to moderately lower Northeast/Appalachian numbers Wednesday ran against the grain of overall firmer spot prices in which gains were mostly small and quotes ranged from flat to more than 30 cents higher. Virtually all of the increases above a dime occurred at Rockies, Pacific Northwest and Northern California points, which are feeling a touch of winter from a Pacific storm.

Raymond James Analysts Bump Average 2003 Gas Price Forecast to $5 Mark

Going against the grain and current consensus views, Raymond James analyst Marshall Adkins and his group said Monday that they believe natural gas prices will average $5/MMBtu next year, which would be about 50% higher than average 2002 prices and substantially higher than most, if not all, other gas price forecasts by analysts, consultants and the federal government.

Overall Market Softness Is Expected to Continue

Pockets of firmness in the West went against the grain of overall price declines ranging from about a nickel to 15 cents elsewhere Wednesday. Most of the declines were around a dime.