The oil and gas industry is adapting to sustained lower commodity prices, all to the good in the U.S. onshore, where the tight oil plays have become commercially viable at an oil price of under $60/bbl, Wood Mackenzie research has found.

Global

Articles from Global

U.S. Onshore E&Ps Eye Smaller, Strategic Deals, While Big Oil Brethren Look Overseas

Big Oil is throwing down investments worldwide to expand long-term reserves, while producers focused on the U.S. onshore have smaller, strategic dealmaking underway in the heart of the country, mostly in the Permian Basin and Oklahoma’s myriad, stacked reservoirs.

Thanks to Shale, U.S. Tops Saudi Arabia, Russia in Recoverable Oil Reserves, Says Rystad

The United States now holds more recoverable oil reserves than Saudi Arabia and Russia, thanks to the unconventional revolution, according to a three-year global review by Rystad Energy.

Brexit Bombshell Spreads Collateral Damage Across Energy Sector

The world’s markets went into a tailspin Friday following a referendum vote by Great Britain to leave the European Union (EU), with the oil and gas sector suffering collateral damage.

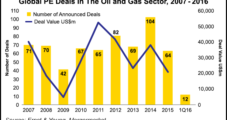

Hefty Private Equity War Chest Readied For NatGas, Oil Investments

Privately backed financial firms have close to $1 trillion ready to deploy into the global oil and natural gas sector, with one-quarter now planning acquisitions by year’s end that mostly target North America and the Asia-Pacific, a survey by Ernst & Young has found.

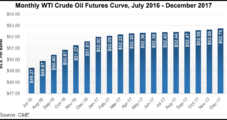

Raymond James Sees WTI Advancing to $80 in 2017, 2018

Raymond James & Associates has increased its 2017/2018 West Texas Intermediate oil price forecast by $5.00/bbl, but cautioned that given the U.S. unconventional industry’s ability to post efficiency gains, the bias over time is for prices to move lower.

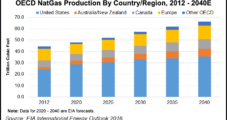

Global NatGas Output, Demand Slowing, With Prices Under Pressure For Years, IEA Says

Natural gas production is slowing worldwide, but it still is seen increasing by more than 100 billion cubic meters (bcm) between 2015 and 2021, one-third of incremental global output, the International Energy Agency (IEA) said Wednesday.

Sidelined Projects Foretell Shortfall in Oil, NatGas Reserves, Say BP, Statoil Economists

The United States last year reinforced its position as the world’s largest natural gas and oil producer, “but don’t be fooled” by the comparative resilience because the sharp pullback in investments may foretell reserves shortfalls within a few years, BP plc’s chief economist said Wednesday.

ExxonMobil Again Largest Traded Oil, NatGas Producer

ExxonMobil Corp. remains the world’s biggest oil and natural gas producer, but its market value has fallen sharply because of slumping commodity prices, according to the annual ranking by Forbes.

Shell Layoffs Climb to 12,500 Since Start of 2015

Royal Dutch Shell plc plans to reduce its workforce by 2,200 more people, bringing global layoffs since the start of 2015 to about 12,500, the company confirmed this week.