Most global oil and gas executives expect to make deals to buy or sell assets in 2019, nearly 10% above the global average, with most of the activity likely to be in the United States, spurred by onshore transactions, and in Canada, according to a recent survey.

Global

Articles from Global

Natural Gas a Destination Fuel, Not Just Bridge to Renewables, Say Energy Chiefs

The energy industry has to counter the view that renewables are the only way to reduce carbon emissions and instead make the case for natural gas to remove any doubts about its long-term benefits, a group of the leading global CEOs said Tuesday.

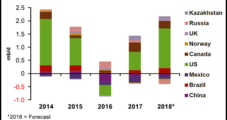

OPEC Sees Murkiness in Global Markets, but Clear-Eyed on Surging U.S. Liquids Output

Global oil supply outside the cartel that makes up the Organization of the Petroleum Exporting Countries, i.e. OPEC, has recovered since contracting in 2016, but uncertainties remain about where the market may be headed through the rest of this year.

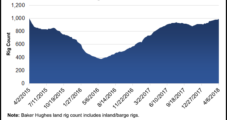

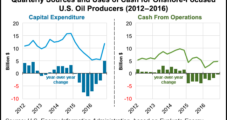

U.S. E&Ps Practicing Capital Discipline Even as Activity Climbs Onshore

The global oil and gas industry has begun its second year of recovery, but capital spending only climbed last year by about half as much as originally budgeted, and it is poised to surge this year, according to a survey by Raymond James & Associates Inc.

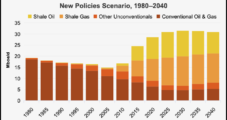

E&P Ingenuity Elevates U.S. as ‘Undisputed Leader’ for Global NatGas, Oil, Says IEA

The resilience of U.S. unconventional natural gas and oil from shale and tight resources has cemented the country’s position as the biggest producer in the world, even at lower prices, the International Energy Agency (IEA) said Tuesday.

OPEC Wants U.S. E&Ps to Share Responsibility for ‘Vicious’ Oil Cycle

The secretary general of the Organization for the Petroleum Exporting Countries (OPEC) is calling on U.S. unconventional producers to help reduce the global oil surplus.

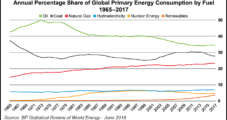

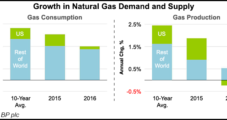

Global Natural Gas Output, Demand Stall in 2016 on Weak Growth, Price Challenges, Says BP

Natural gas demand worldwide rose by only 1.5% last year, slower than the 10-year average, while production climbed a mere 0.3%, the weakest growth in almost 34 years, with U.S. output falling for the first time since the shale revolution, BP plc said Tuesday.

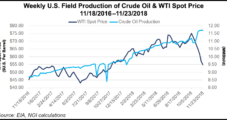

Lower 48 Oil Growth Potential Drag on Prices, Says IEA

U.S. producers, eager to get rigs back to work in the Lower 48, may be the drag on strengthening oil prices after global output increased to 9 million b/d in March from a trough of 8.6 million b/d last September, the International Energy Agency (IEA) said Thursday.

Oil, NatGas Prices Top Energy Concern as Disruptive Technologies Upend Outlook, Says World Energy Council

Shifting priorities of energy executives worldwide are putting more impetus on a lower-carbon future, while oil and natural gas price volatility remains the No. 1 “critical” uncertainty, according to the World Energy Council.

U.S. Onshore E&Ps Leading Charge in Global Spending

Global producers, led by U.S. operators, are opening their wallets again, but oil prices still may not be high enough to support sustainably stronger investments beyond 2017.