A 549 MW natural gas-fueled power plant is slated for Marshall County, WV, and will take advantage of nearby Marcellus Shale gas supplies, its developer said.

Generate

Articles from Generate

SM Energy Selling Anadarko Basin Properties

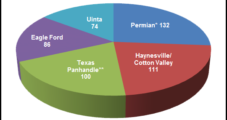

Denver-based SM Energy Co. is marketing all of its properties in the Anadarko Basin, including its Granite Wash interests. The sale of the gas-weighted assets is part of normal high-grading activities, the company said Wednesday. Proceeds could be spent in the Permian Basin or in the Eagle Ford Shale, analysts speculated Wednesday.

Chevron, Cimarex Expand Delaware Basin Opportunities

Chevron Corp. will gain access to some needed infrastructure to develop a portion of its one million-acre leasehold in the Permian Basin in West Texas, and Cimarex Energy Co. will have expanded opportunities in a key Texas county under a joint agreement.

$4.00-Plus Called ‘Breakeven’ for U.S. Natural Gas

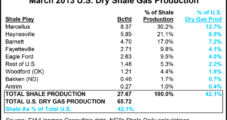

Nearly every major natural gas play in the United States makes money at prices above $4.00/Mcf, and more important, may generate a “decent rate of return” at prices above $4.25, according to an analysis by Raymond James & Associates Inc.

Most U.S. NatGas Plays Make Money at $4.00-Plus, Says Raymond James

Nearly every major natural gas play in the United States makes money at prices above $4.00/Mcf, and more important, can generate a “decent rate of return” at prices above $4.25, according to an analysis by Raymond James & Associates Inc.

Price Trigger at $4.00-Plus for ‘Breakeven’ U.S. Natural Gas

Nearly every major natural gas play in the United States makes money at prices above $4.00/Mcf, and more important, may generate a “decent rate of return” at prices above $4.25, according to an analysis by Raymond James & Associates Inc.

Shale-Driven Chemical Projects A Tax Bonanza

Nearly 100 shale gas-driven chemical industry projects in the United States, worth about $71.7 billion, will generate $20 billion in federal, state and local tax revenue by 2020, according to an analysis by the American Chemistry Council (ACC).

$2B in Tax Revenue Expected from Shale-Driven Chemical Projects

Nearly 100 shale gas-driven chemical industry projects in the United States — worth about $71.7 billion — will generate $20 billion in federal, state and local tax revenue by 2020, according to an analysis released Monday by the American Chemistry Council.

Forest to Run Faster in Eagle Ford on $90M Drilling Carry

Forest Oil Corp. has struck an agreement with Schlumberger that the company said will allow it to accelerate development of its Eagle Ford Shale acreage.

ISO-NE Renews Concerns About Growing Dependance on NatGas

Over the past 10 years natural gas has become the predominant fuel used to generate electricity in New England, a shift that has “provided clear economic benefits” for the region, but has also created “serious reliability threats to the bulk power system,” according to Gordon van Welie, CEO of ISO New England Inc. (ISO-NE).