EnLink Midstream LLC continues to see signs of an increasing need for natural gas, with the Permian Basin poised for significant growth ahead following a record quarter. Dallas-based EnLink reported that average natural gas gathering volumes in the Permian were about 6% higher sequentially and 15% higher than the prior-year quarter. Average natural gas processing…

Gathering

Articles from Gathering

LM Energy Pivots to Delaware Basin Natural Gas with Sale of Touchdown Crude Gathering Assets

LM Energy Holdings LLC is aiming to sell parts of its crude oil gathering business in the New Mexico portion of the Permian Basin to help fuel a focus shift to natural gas. The Dallas-based midstreamer disclosed it has entered into agreements to sell assets and subsidiaries of its Touchdown crude oil gathering system in…

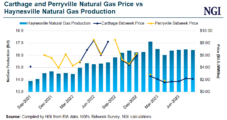

Clearfork Midstream Completes 65% Natural Gas Capacity Increase in Haynesville

Clearfork Midstream LLC said Tuesday it culminated a series of expansions across its Holly System in North Louisiana, boosting its gathering and processing (G&P) volumes there above 1.0 Bcf/d as the company responds to strong demand from natural gas producers in the Haynesville Shale. “These significant system upgrades extend” Clearfork “into new areas throughout the…

Business Booming for Natural Gas G&P in Oily Onshore Basins, Says Crestwood CEO

It’s a good time to be in the natural gas gathering and processing (G&P) business, particularly in oil-weighted basins such as the Permian, Powder River and Williston, according to Crestwood Equity Partners LP CEO Robert Phillips. Phillips hosted a conference call on Tuesday to discuss first quarter results. Through a series of mergers and acquisitions…

Summit Midstream Triples DJ Natural Gas Processing with Outrigger Purchase

Outrigger Energy II LLC has completed the sale of its midstream system in Weld County, CO, to Summit Midstream Partners LP. Summit Midstream previously said the deal was worth about $305 million total in cash. Outrigger’s Denver-Julesburg (DJ) Basin system includes a 60 MMcf/d cryogenic natural gas processing plant with product deliveries to the Cheyenne…

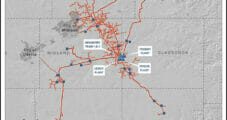

Matador Building Permian Midstream Portfolio to Ensure Natural Gas Takeaway

Matador Resources Co. has agreed to purchase Summit Midstream Partners LP’s Lane natural gas gathering and processing (G&P) system in New Mexico’s Eddy and Lea counties for $75 million. In connection with the deal, Matador “will assume certain takeaway capacity on the Double E pipeline, a FERC-regulated natural gas pipeline operated by Summit,” the Dallas-based…

Targa Consolidating Permian Natural Gas Gathering Footprint with Southcross Acquisition

Targa Resources Corp. said Thursday it has signed agreements to acquire Southcross Energy Operating LLC and its subsidiaries in South Texas for $200 million in a deal that will consolidate Targa’s natural gas gathering and processing footprint. The Southcross assets include a currently idle 200 MMcf/d natural gas processing plant, Houston-based Targa said. Through the…

Enterprise Opens Door to Permian Midland with $3.25B Navitas Takeover

Houston’s Enterprise Products Partners LP has agreed to acquire Navitas Midstream Partners LLC for $3.25 billion, giving the giant partnership an entry point in the Permian Basin of West Texas and an additional 1 Bcf/d of natural gas processing capacity. The agreement to acquire Navitas, headquartered north of Houston in The Woodlands, could be completed…

UGI Growing Appalachia Midstream Footprint with Stonehenge Purchase

A UGI Corp. subsidiary is adding more than 47 miles of natural gas pipeline to its portfolio in Appalachia with the $190 million purchase of midstream assets from Stonehenge Energy Holdings LLC. The deal to acquire Stonehenge Appalachia LLC also includes associated compression assets, along with gathering capacity of 130 MMcf/d, all located in Butler…

Energy Transfer to Take Out Enable Midstream for $7.2 Billion, Expand Natural Gas Footprint

Major U.S. pipeline operator Energy Transfer LP said Wednesday it would pay $2.6 billion in an all-stock deal to acquire Enable Midstream Partners LP. Including debt, the transaction is valued at $7.2 billion. Energy Transfer, whose plan to expand the controversial Dakota Access crude oil pipeline has been met with repeated court challenges and setbacks,…