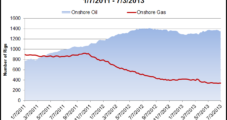

The capital markets for U.S. exploration and production (E&P) companies “appear wide open,” with most of the available funds likely to target onshore oil instead of natural gas through 2014, Barclays Capital analysts said on Wednesday.

Floors

Articles from Floors

FERC Conference Explores Reasonable Conduct, Business Practices

The threat of after-the-fact rules, prosecutions and penalties has become so great that the rule-of-thumb on many trading floors is, “If you can make money at it, don’t do it,” industry witnesses told a Federal Energy Regulatory Commission technical conference on standards of conduct and market behavior rules for the natural gas and electric markets in Chicago Friday.

Storage-Wednesday Has Something for Both Bulls and Bears

Speculation around the much anticipated storage report continuedto run rampant yesterday on trading floors across the natural gasindustry and that coupled with steady fund buying was enough tolift the futures market higher for the third day in a row. TheSeptember contract raced off to a fast start, but was unable toretest the $2.72 high set last Thursday. After notching a $2.66high trade around 10:30 EST the prompt month was left to chopsideways before eventually settling up 4.4 cents at $2.642.

Richardson: More Help On the Way for Producers

While making clear the administration would not be engaging inany market-rigging through price ceilings or floors, EnergySecretary Bill Richardson said it nevertheless was working onfurther measures to aid the depressed oil and gas industry.