Global energy-related carbon dioxide (CO2) emissions, considered the largest source of man-made greenhouse gas emissions, remained flat in 2015 for the second year in a row, in part on the rising use of natural gas, according to an analysis of preliminary data by the International Energy Agency (IEA).

Flat

Articles from Flat

NGSA Winter Outlook Calls for Flat Gas Prices

Based on projections of flat natural gas demand, record production and unseasonably warm weather, natural gas prices this winter are expected to be flat compared with a year ago, when Henry Hub prices averaged $3.47/MMBtu, according to the Natural Gas Supply Association’s (NGSA) 13th Annual Winter Outlook.

Oxy is California Dreamin’ About Monterey Shale

California’s Occidental Petroleum Corp. (Oxy) is eyeing 7 billion bbl of reserves from the Monterey Shale and other projects in the state, the management team said Tuesday.

Comstock’s Now and Later Plays: Eagle Ford, Haynesville

With the proceeds counted from the sale of its Permian Basin acreage earlier this year, Frisco, TX-based Comstock Resources Inc. is squarely focused on the Eagle Ford Shale of South Texas, where it is drilling longer-lateral wells for less money in fewer days and looking for bolt-on acreage acquisitions. The Haynesville Shale will have to wait.

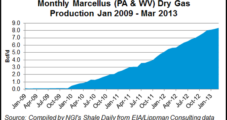

Marcellus Volumes, Capacity Prove Challenging, Says MarkWest CEO

Building midstream infrastructure in the Marcellus Shale to keep up with growing natural gas volumes was a challenge in the first quarter, MarkWest Energy Partners LP CEO Frank Semple said Thursday.

Devon’s Permian Success Lifts U.S. Oil Output 23%

A standout performance in the Permian Basin increased oil production 23% year/year in the first three months of this year, but it’s not the only racehorse in the stable, Devon Energy Corp.’s top executive said Wednesday. Encouraging results from the emerging Mississippian Lime, for example, may provide the “next leg of growth.”

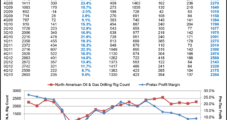

NatGas Prices Forecast Higher, but Coal Seen Gaining

A flat domestic natural gas rig count, combined with an eroding storage overhang, provide opportunities for U.S. gas prices and related operators to trade higher this year, according to BMO Capital Markets Dan McSpirit and Phillip Jungwirth. Bank of America Merrill Lynch (BofA) also expects higher gas prices on average, but coal may regain some of the market this summer.

Baker Hughes Sees ‘Modest’ Uptick in U.S. Rig Count; Schlumberger Uncertain

No. 3 oilfield services provider Baker Hughes Inc. on Friday reported a 30% drop in first quarter profits, stung by weak North American drilling, its biggest market. Schlumberger Ltd., the world’s largest oilfield services operator, also reported a drop in quarterly profits on declines in North America, and management said the outlook for the United States and Canada this year remains uncertain.

Marcellus Is Still Golden Child Among Cabot’s Plays

Despite a year of languishing natural gas prices, Cabot Oil & Gas Corp. annual revenues for the first time surpassed $1 billion in 2012. Cash flow set records as proved reserves grew by 27% to 3.8 Tcf on organic growth that replaced 417% of record production. The Marcellus Shale gave much despite infrastructure challenges.

Canada Oilsands Industry in Need of New Markets

A glut of light oil supplies from tight oil fields into the Midwest has depressed regional prices, making it imperative for Canada’s oilsands producers to find alternative markets for their product, consultancy IHS CERA said in a Jan. 14 report.